- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Annualized Income Michigan

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Annualized Income Michigan

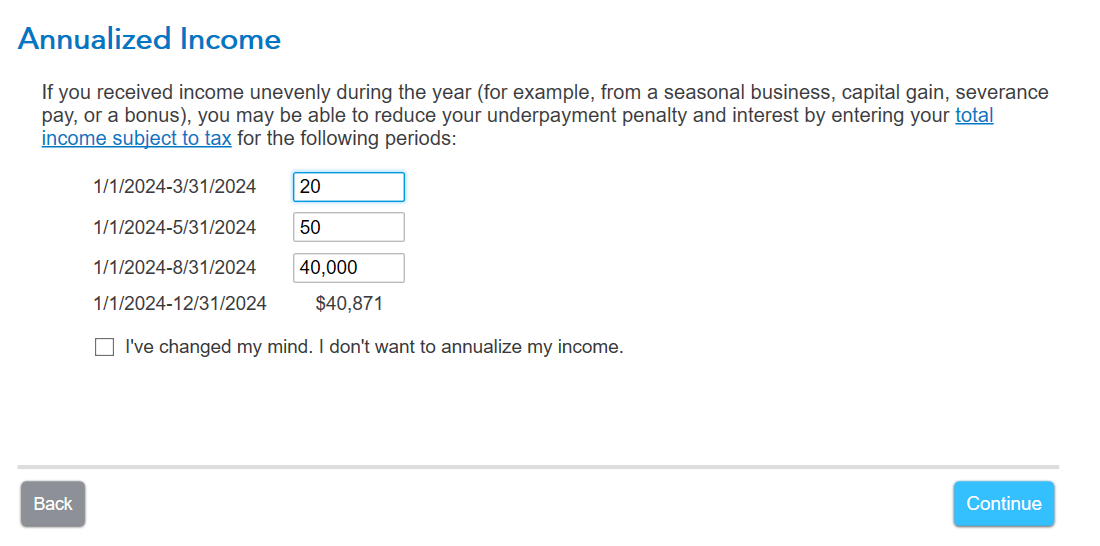

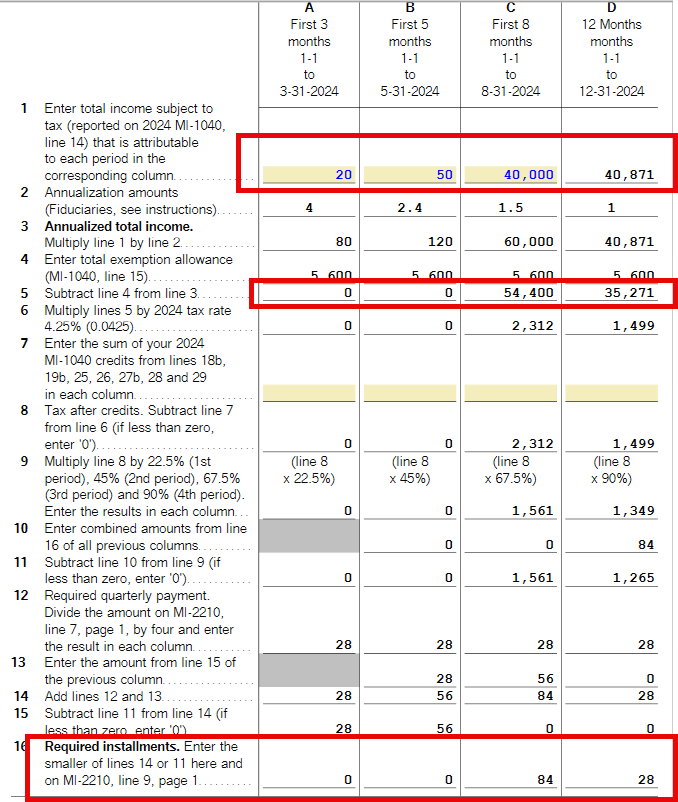

I would like to minimize my underpayment penalty by completing the Annualized Income amounts for the periods described on MI-2210. Almost all the income for the year came on two dates, 10/9/24 & 12/2/24. The amounts of income on these two dates have associated 1099R forms indicating taxable income. The sum of income received after 8/31 is greater than the 12 month income on the Annualized Income Worksheet column D section of the MI-2210. I would have to enter negative income for the first three periods to have an agreeing annual income amount and that is not correct.

There is something I do not understand about how to the amounts of taxable income. The ones on 12/2 were from Roth Conversions, the ones on 10/9 were terminations of annuity contracts. The associated 1099Rs list amounts of taxable income.

If I can correctly enter the amount of income received after 8/31, I would like to subtract that amount from the yearly income to arrive at a monthly annualizing amount for the the other periods.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Annualized Income Michigan

When you go through the program, it allows you to fill in the boxes for the first 3 quarters of income. I put very minimal numbers in to force the income into the 3rd quarter primarily. You enter the correct amount of income for each quarter based on your final taxable income. This shows you the various annual incomes across the columns.

Take a look at your MI-2210 for the computations. To print or view your forms:

- In desktop, switch to Forms Mode.

- For online:

- On the left side, select Tax Tools

- Select Print center

- Select Print, save or preview this year's return

- If you have not paid, select pay now.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

matto1

Level 2

sakilee0209

Level 2

CI Guy

Level 2

user17518667980

New Member

iDas

Level 2