- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- Re: Section 179 (or bonus depreciation) vehicle

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 (or bonus depreciation) vehicle

In 2018 we purchased a business vehicle over 6000 lbs for $54k

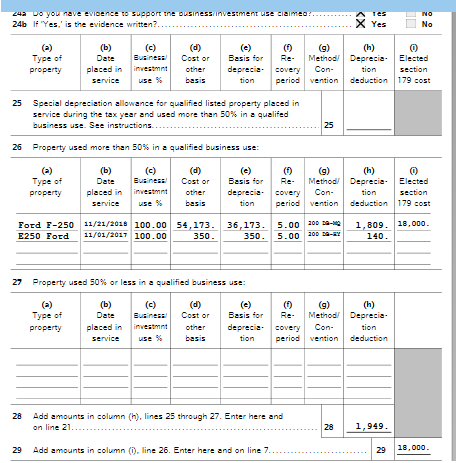

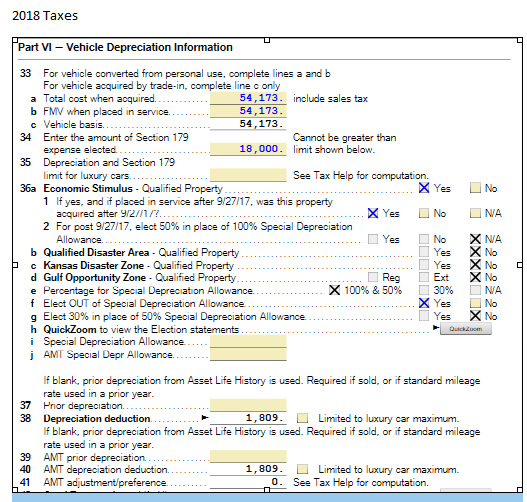

I attempted to depreciate over 5 years and was given a schedule of 18k yr 1 (18k went to section 179 and $1,809 was regular depreciation), $13,746 yr 2, $8,247 yr 3, $4,948 year 4, and the remainder this year.

While doing my taxes this year it is asking about the bonus depreciation that we took. I assume it is the 18k but I'm not sure since box 25 is blank in my 2018 taxes.

In my 2022 taxes I am getting an error under part VI section i and j as it is asking for Special Depreciation Allowance and/or AMT Special Depreciation Allowance.

Any help is appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 (or bonus depreciation) vehicle

In your situation, bonus depreciation for this vehicle is $0. You took a partial Section 179 deduction and depreciated the remainder of the value, but did not take any bonus depreciation. You need to leave the bonus depreciation question blank.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 (or bonus depreciation) vehicle

I appreciate your reply. For the 2022 tax form, do you think I should change ‘question ‘e’ to N/A from ‘yes’?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 (or bonus depreciation) vehicle

Yes, that is what you need to do.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Raj1

Level 3

Shawn B1

Returning Member

ahlopi

New Member

martae05

New Member

David581

Level 3