- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 (or bonus depreciation) vehicle

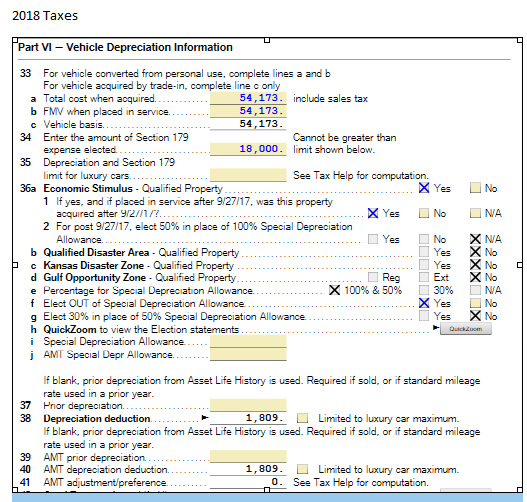

In 2018 we purchased a business vehicle over 6000 lbs for $54k

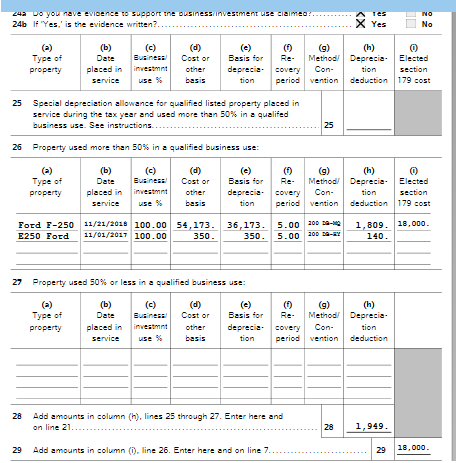

I attempted to depreciate over 5 years and was given a schedule of 18k yr 1 (18k went to section 179 and $1,809 was regular depreciation), $13,746 yr 2, $8,247 yr 3, $4,948 year 4, and the remainder this year.

While doing my taxes this year it is asking about the bonus depreciation that we took. I assume it is the 18k but I'm not sure since box 25 is blank in my 2018 taxes.

In my 2022 taxes I am getting an error under part VI section i and j as it is asking for Special Depreciation Allowance and/or AMT Special Depreciation Allowance.

Any help is appreciated.

Topics:

April 14, 2023

4:52 PM