- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- Re: Odd Job Income

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Odd Job Income

How do I report odd income?

posted

April 7, 2023

5:47 PM

last updated

April 07, 2023

5:47 PM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

2 Replies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Odd Job Income

If you received odd job self-employment income that was not included on a Form 1099, you may enter that in the Add Income section of the Schedule C. Cash App transactions, cash, checks, and other methods of payment can be entered here. You will need the Self-Employed version of TurboTax Online or the Home and Business version of TurboTax Desktop/Download.

- Click on Wages and Income on the left menu

- Scroll down to Self-Employment and click on Show More

- Click on Start or Revisit for Self-employment income and expenses

- When you get to the Income and Expenses section

- Click on the Add Income button

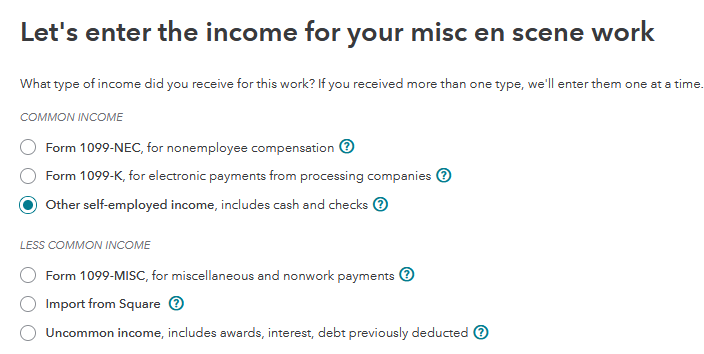

- Select Other self-employed income, includes cash and checks and Continue.

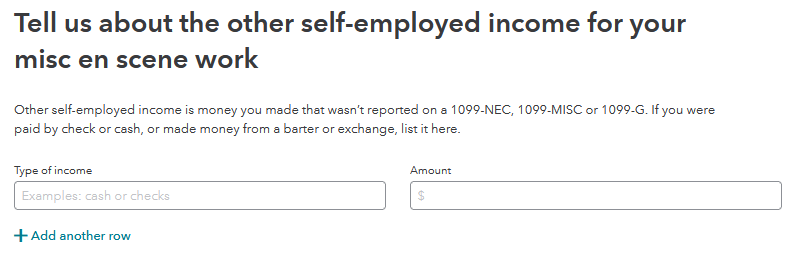

- Enter a Description, such as Cash App, and the Amount.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 7, 2023

7:33 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Odd Job Income

"How do I report odd income"

A: Type more.

April 8, 2023

9:07 AM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gxt1

Level 3

savedspirit13

New Member

rlynng5816

New Member

aydenrigsby25

New Member

mrk72

Level 2