- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self employed

If you received odd job self-employment income that was not included on a Form 1099, you may enter that in the Add Income section of the Schedule C. Cash App transactions, cash, checks, and other methods of payment can be entered here. You will need the Self-Employed version of TurboTax Online or the Home and Business version of TurboTax Desktop/Download.

- Click on Wages and Income on the left menu

- Scroll down to Self-Employment and click on Show More

- Click on Start or Revisit for Self-employment income and expenses

- When you get to the Income and Expenses section

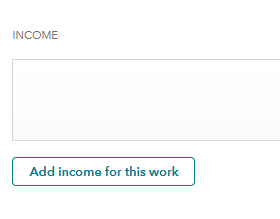

- Click on the Add Income button

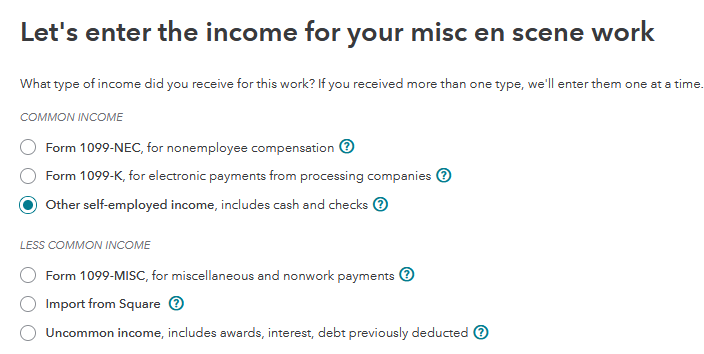

- Select Other self-employed income, includes cash and checks and Continue.

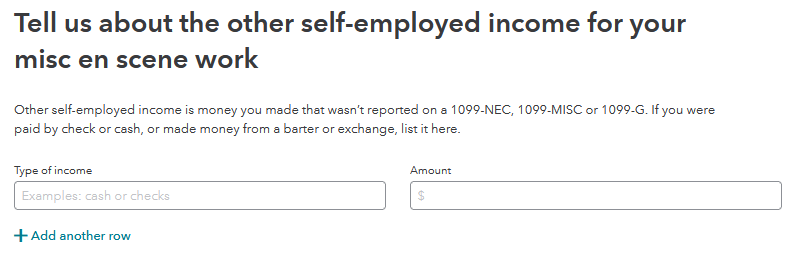

- Enter a Description, such as Cash App, and the Amount.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 7, 2023

7:33 PM