- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- Re: DoorDash

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DoorDash

I made under $600 which means no 1099. Where do I start in TT to report my income? I've watched videos but they were more of how to calculate what you owe, etc... I'm looking for step by step instructions in TT.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DoorDash

Here is a link for the steps to start your Schedule C to report business income and expenses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DoorDash

Do I click on I use my own name for my business name and business description would be DoorDash?

Do I click on I started (or aquired) my business in 2023? If that is checked, then it asks for the date I started or aquired this business. What do I put there? Or do I check Neither of these apply (The other option was I sold (or disposed of) my business in 2023?

Did I pay any employees in 2023? That would be a no

Do you have an EIN? That would be no

It's asking for a business code. I clicked on lookup business code and DoorDash is not found. What now?

Do you use the Cash Method of accounting to run your business? How is this to be answered?

If I answer yes, it asks me Did you make any payments that required you to issue a form 1099?

Few more questions after that but I did not get a part that said Other Self Employed income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DoorDash

Do I click on I use my own name for my business name and business description would be DoorDash?

Your name. You use DoorDash, but DoorDash is NOIT your employer nor the name of your business.

Do I click on I started (or aquired) my business in 2023? If that is checked, then it asks for the date I started or aquired this business. What do I put there? Or do I check Neither of these apply (The other option was I sold (or disposed of) my business in 2023?

YES, If you started doing this in 2023, enter the date you started driving for Uber.

This is needed for calculating depreciation on your car if you use the Actual Expense Method for the vehicle.

Did I pay any employees in 2023? That would be a no

Do you have an EIN? That would be no

It's asking for a business code. I clicked on lookup business code and DoorDash is not found. What now?

Food Delivery is code 492000

Do you use the Cash Method of accounting to run your business? How is this to be answered?

If I answer yes, it asks me Did you make any payments that required you to issue a form 1099?

Answer YES to Cash Methos and NO to Form 1099

[Edited 2/13/2024 I 6:17 AM ]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DoorDash

Since this was DoorDash and not Uber, what code would be used?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DoorDash

Food Delivery is code 492000

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DoorDash

Thank you for the information. I'm not seeing anywhere where it says Other Self-employed income. Where is this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DoorDash

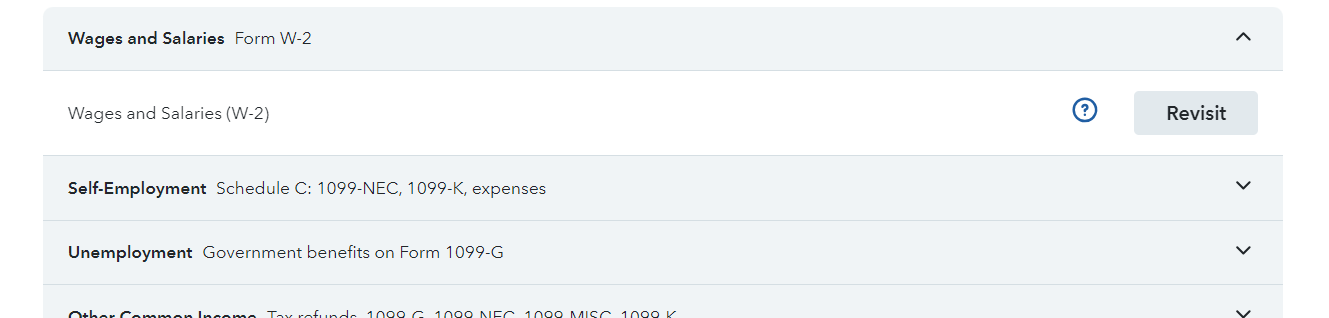

If you go to the wages and income screen, then scroll down a bit, you will see Self-Employment Schedule C. Click on the drop down arrow next to Self-Employment Schedule C and you can begin to enter all of your Door Dash income and expenses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DoorDash

I'm here. Where do I go? I do not see what you are describing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DoorDash

From the screen you posted, click Update beside Business Income. This will open a page with several categories of income. Choose General Income to report your income not reported on a tax form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

champ121

Level 2

soccertica98

New Member

hildasoqui32

New Member

Coxc22

New Member

Ewiper3

Level 1