- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- Re: AMENDMENT IN PROGRESS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AMENDMENT IN PROGRESS

I am trying to submit an AMENDMENT because I forgot to add my LLC.. I know..

Now, I bought an asset in 2021 and added to my tax return in 2022.

I had the option to only add half of the asset value and save the other half to fill it for this year.

Now, that I am trying to fill the a AMENDMENT I do not know how to fill for the other half of the asset value for this year. How can I do that?? I am using the same account that I have used for 6 years.

I try to download the pdf from last year but the pdf it downloads it is empty..

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AMENDMENT IN PROGRESS

To clarify, are you asking where in the return to add the second half of the asset or how to enter it? if this how you enter, did you take a full 179 deduction a year before for 1/2 of the asset? What type of an asset is it?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AMENDMENT IN PROGRESS

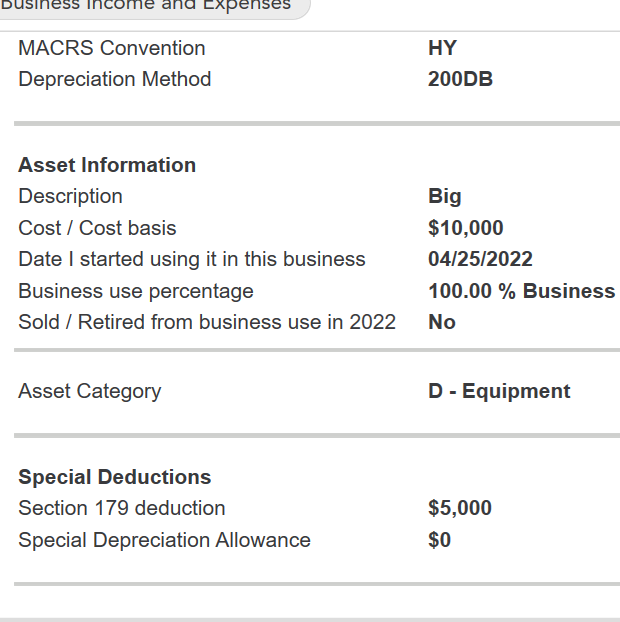

I was able to download the tax document from last year.

Here is what I am talking about.

10,500 and elected for that year $5000.

How can I add the rest for this year, $5500?

it is under, Election To Expense Certain Property Under Section 179

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AMENDMENT IN PROGRESS

It is an asset and now you depreciate it on this year's tax return. If you used TurboTax in the prior year the information would automatically populate this year's return if entered accurately in prior year.

I did a re-enactment but I am using 2022 for all of the transaction.

The above shows what should have happened in 2021. But you also got another $1000 which was the current year depreciation. So last year was $1000.

If you used TurboTax last year and using same logon info, it should be there.

If not, go your Business Tab and select Business Assets to enter the information. The interview questions will setup the asset for you.

To enter depreciation just go to Business then expenses then follow the prompts.

Hopefully this helps.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AMENDMENT IN PROGRESS

So, this is how I did it. Let me know if I did it correctly:

Select the carryover option:

Selected 179 option here

Added the amount here:

Let me know if I did it correctly.

Thanks!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AMENDMENT IN PROGRESS

Yes if you are amending your 2021 tax return you are taking the right steps. Simply enter the asset as though you chose Section 179 for the entire cost. Your 2021 tax return shows that you elected to expense $5,000 of your $10,550 total cost of a new asset. The remainder of $5.550 must be depreciated and I would assume was depreciated in part in 2021, because this would be the second year to depreciate the remaining balance of that portion of the cost, if you do not amend.

Option:

You can file your 2022 return as though you already used the Section 179. You can continue to complete your amended 2021 return and choose to use Section 179 for the entire cost of the asset placed in service in 2021. File your 2022 return correctly as though you already selected to use your Section 179 last year.

[Edited: 03/21/2023 | 1:31p PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AMENDMENT IN PROGRESS

Hello,

Thank you for your reply!!

How do I depreciate the reminder 5,550?

I didn't give me an option to do so.

Thanks!

You guys rock!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AMENDMENT IN PROGRESS

When you entered the asset in the year you first put it into service for the business, you chose to take a section 179 deduction of $5,000. TurboTax would give you that deduction and take normal deprecation for the rest of the cost starting in the year you first entered it. So, you wouldn't need to enter anything new in the following years, TurboTax would calculate your depreciation automatically. You can't split the section 179 allowance up between years, you get the full amount you choose in the year you enter the asset, any remaining allowance not available because of income restrictions would be carried over to the next year by TurboTax. But, you can't choose to take a $5,000 section 179 allowance in year one and another $5,000 in the next year, it doesn't work like that.

If you are trying to enter an asset because it is not showing in the current year for some reason, you will need to re-enter the cost and the section 179 allowance you took in the first year and normal depreciation taken in prior years and enter any unused section 179 carried over from the previous year, if any. You will see an option to make those entries when you enter the asset in TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sofic-kemal

New Member

Melody2525

Level 2

1099-NECDude

Level 1

Gary Mirsky

New Member

untuit

Level 3