- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self employed

It is an asset and now you depreciate it on this year's tax return. If you used TurboTax in the prior year the information would automatically populate this year's return if entered accurately in prior year.

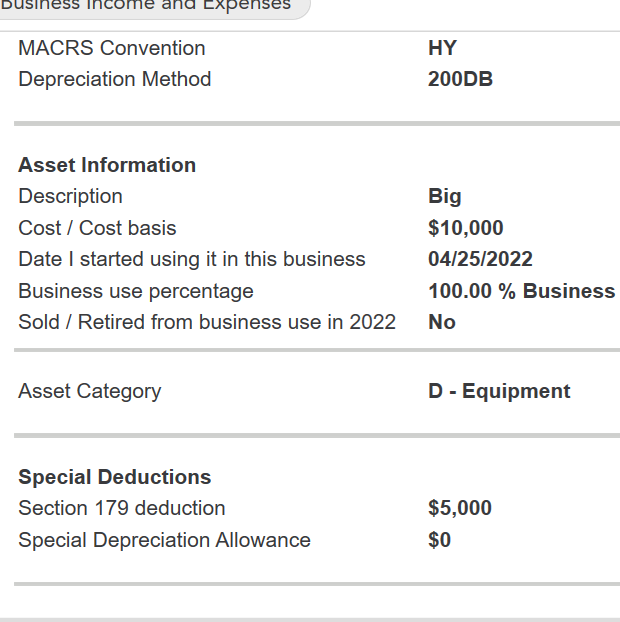

I did a re-enactment but I am using 2022 for all of the transaction.

The above shows what should have happened in 2021. But you also got another $1000 which was the current year depreciation. So last year was $1000.

If you used TurboTax last year and using same logon info, it should be there.

If not, go your Business Tab and select Business Assets to enter the information. The interview questions will setup the asset for you.

To enter depreciation just go to Business then expenses then follow the prompts.

Hopefully this helps.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 21, 2023

12:33 PM