I suggest double checking that the retirement rollover reported to you on 1099-R has been indicated as a rollover.

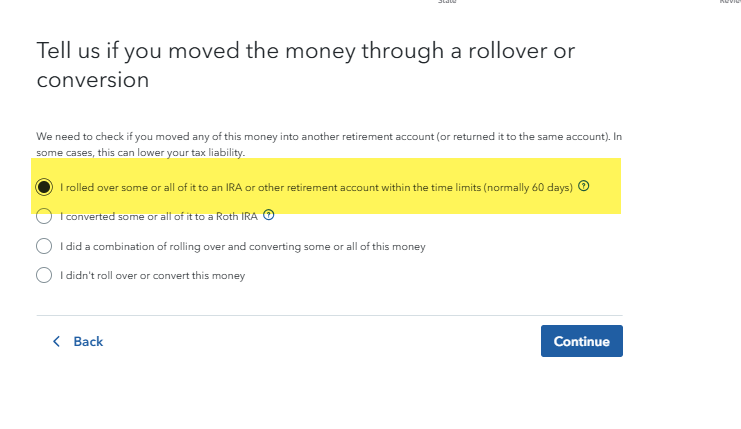

You can revisit the 1099-R section. After entering/checking the data, you will come to a screen with the heading "Tell us if you moved the money through a rollover or conversion"

- Select "I rolled over some or all of it to an IRA or other retirement account within the time limits (normally 60 days)"

- On the next screen indicate you rolled all of it over.