- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- When I get to the final step of my State tax return it says you can’t E file because of a form IT225 ? None of the things on that form relate to me . How do I l

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I get to the final step of my State tax return it says you can’t E file because of a form IT225 ? None of the things on that form relate to me . How do I l

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I get to the final step of my State tax return it says you can’t E file because of a form IT225 ? None of the things on that form relate to me . How do I l

Per New York State, you have to complete Form IT-225 and submit it with your return to report any New York additions and subtractions that do not have their own line on your return.

Before you delete the form from you return, you should look at Instructions for Form IT-225 on page 17-19 of the PDF file to see if you have any additions or subtractions that need to be entered on this form. If you do, then New York State provides the corresponding code for you.

If you have determined this does not apply to your return, you can delete the form.

To do so, please follow these steps:

- Open your tax return.

- Click on Tools.

- Click on Delete a Form.

- Scroll down to your state forms and look for IT-225 and click Delete.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I get to the final step of my State tax return it says you can’t E file because of a form IT225 ? None of the things on that form relate to me . How do I l

Per New York State, you have to complete Form IT-225 and submit it with your return to report any New York additions and subtractions that do not have their own line on your return.

Before you delete the form from you return, you should look at Instructions for Form IT-225 on page 17-19 of the PDF file to see if you have any additions or subtractions that need to be entered on this form. If you do, then New York State provides the corresponding code for you.

If you have determined this does not apply to your return, you can delete the form.

To do so, please follow these steps:

- Open your tax return.

- Click on Tools.

- Click on Delete a Form.

- Scroll down to your state forms and look for IT-225 and click Delete.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I get to the final step of my State tax return it says you can’t E file because of a form IT225 ? None of the things on that form relate to me . How do I l

I do not see a tool button ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I get to the final step of my State tax return it says you can’t E file because of a form IT225 ? None of the things on that form relate to me . How do I l

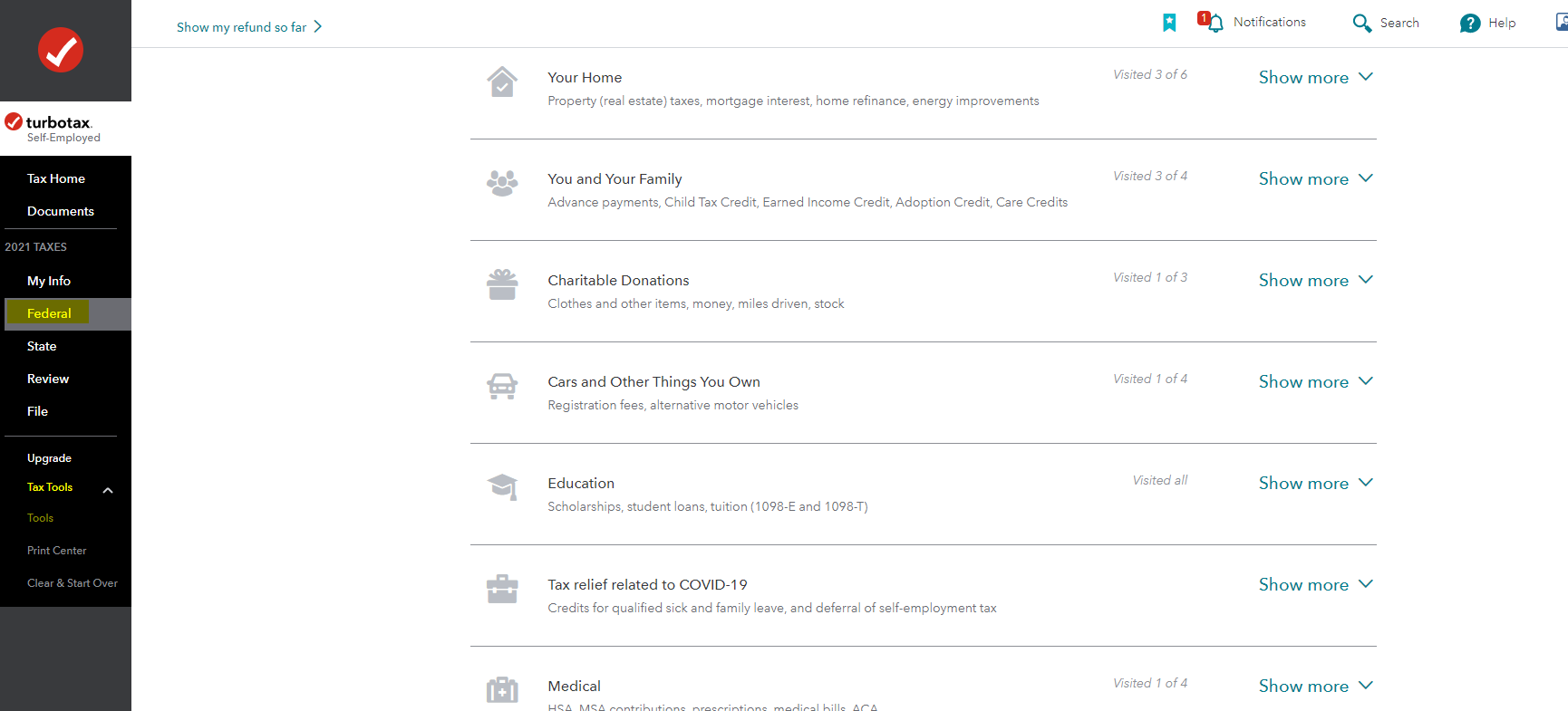

@tdag0428, Please see the snippet below. However, as LenaH stated above, please be very careful before deleting any forms.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DanTheMan

Level 2

missjessybrown

New Member

Sophias_Dad

New Member

KarenL

Employee Tax Expert

seiftwin1

New Member