- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Unsure how to report Roth IRA Contribution and Early Distribution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

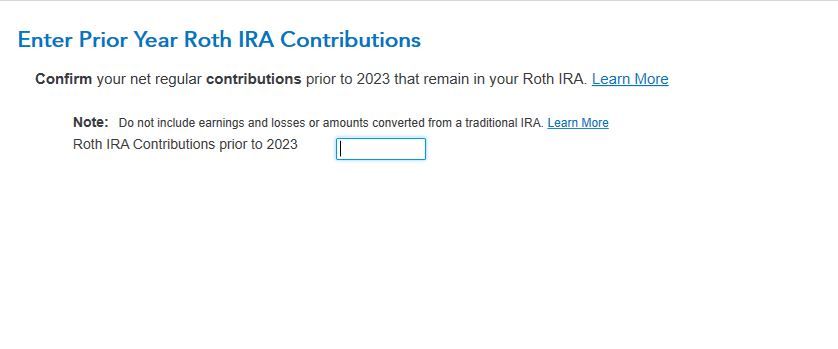

Unsure how to report Roth IRA Contribution and Early Distribution

Hello, I'm using the TurboTax desktop version. I opened my Roth IRA in 2021 and contributed $3000. I did a $2,847 distribution in Jan 2023. Now I have the 1099-R and box 2b (Taxable amount not determined) is checked with the total distribution as blank. I am under 59 and my account is still open with $1.45 since many investments did poorly. I got up to this question and wondered what amount I would enter to confirm my net regular contributions prior to 2023 that remain in my Roth IRA. Would it be the $3000 initial contribution in 2021? I also received a Form 5498 for 2021.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unsure how to report Roth IRA Contribution and Early Distribution

You are required to maintain your own records of contributions removed from a Roth IRA.

Some contributions removed may be reported on Form 8606,

Only you know the total amount of contributions remaining.

TurboTax tries to track it but you can't rely on that 100% even if you are a life long user of TurboTax.

As for the Note: conversions are tracked separately, adding more complexity.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unsure how to report Roth IRA Contribution and Early Distribution

Based on my comment, what value did you decide to enter in the box ?

Did TurboTax already show an amount in the box to confirm?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

megan0956

Returning Member

SoCalRetiree

Level 1

ayubruin7777

Level 1

Andy_W

Level 1

jjyoo92

New Member