- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unsure how to report Roth IRA Contribution and Early Distribution

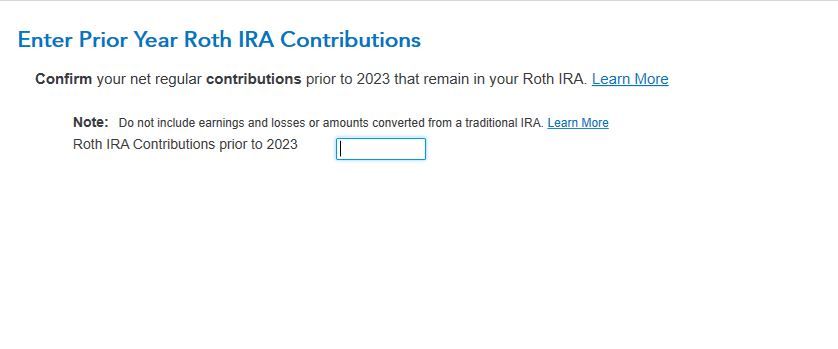

Hello, I'm using the TurboTax desktop version. I opened my Roth IRA in 2021 and contributed $3000. I did a $2,847 distribution in Jan 2023. Now I have the 1099-R and box 2b (Taxable amount not determined) is checked with the total distribution as blank. I am under 59 and my account is still open with $1.45 since many investments did poorly. I got up to this question and wondered what amount I would enter to confirm my net regular contributions prior to 2023 that remain in my Roth IRA. Would it be the $3000 initial contribution in 2021? I also received a Form 5498 for 2021.

April 2, 2024

3:36 PM