- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- TurboTax 2024 created an 8606 instead of applying contribution to traditional IRA in 2025 for 2024

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2024 created an 8606 instead of applying contribution to traditional IRA in 2025 for 2024

Wife's traditional IRA contribution was not deducted from AGI. TT noted that the contribution was over the limit for work when covered by a retirement plan at work. She is not in a retirement plan at work and that is correctly entered into TT W-2 section. IRS Pub 590 tells me she (and we) is well beneath the AGI limit.

TT created an 8606 for NON-DEDUCTABLE contribution though that was not what was entered in the interview section.

The contribution in 2025 for 2024 Traditional IRA appears correctly entered but no deduction. The TAX refund is way, way less than total TAX paid and effective tax rate is 11.19%.

How can I get TT to properly deduct the IRA contribution?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2024 created an 8606 instead of applying contribution to traditional IRA in 2025 for 2024

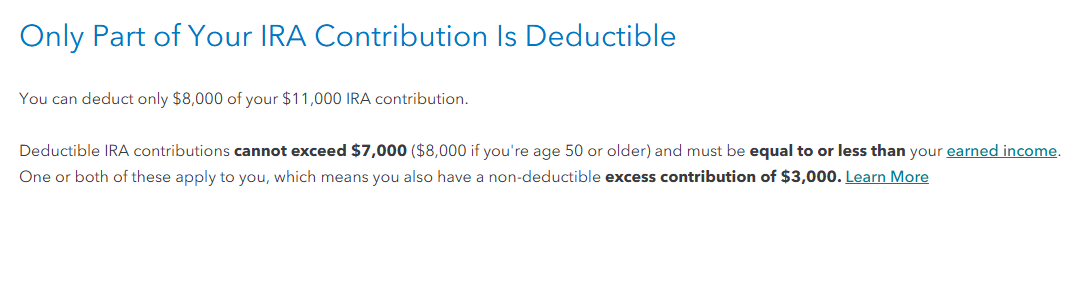

When entering your traditional IRA contribution, you may seen a screen that reports whether the traditional IRA contribution qualifies to be fully deductible.

Did you receive a notice of how TurboTax was treating your spouse's traditional IRA contribution?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

prit

Level 1

tyentr99

Level 1

BME

Level 3

user17577855205

Level 1

mt56

Level 2

Want a Full Service expert to do your taxes?