- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Trying to add my wifes 1099-NEC in on here, but even though I select her as the recipient of the 1099...it has my name on the next page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to add my wifes 1099-NEC in on here, but even though I select her as the recipient of the 1099...it has my name on the next page

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to add my wifes 1099-NEC in on here, but even though I select her as the recipient of the 1099...it has my name on the next page

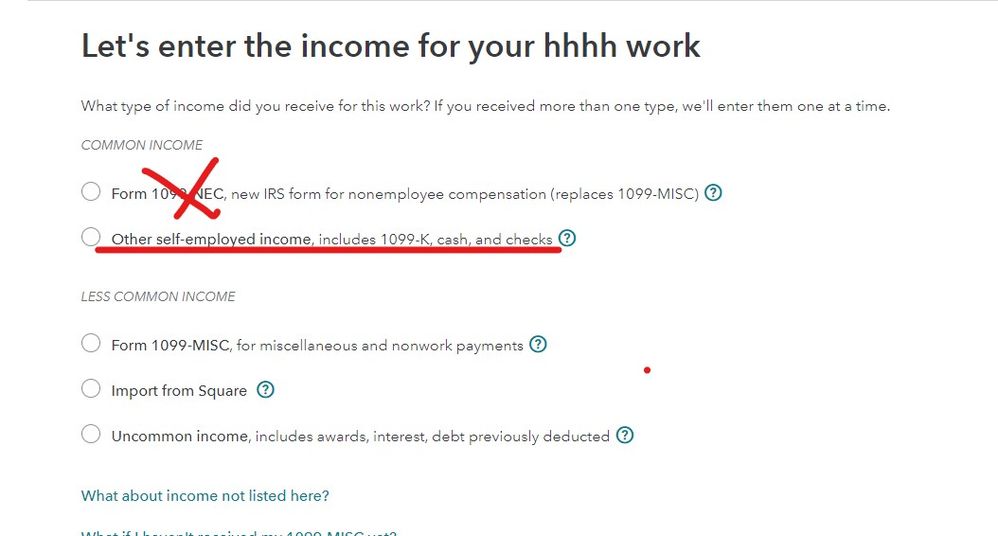

Today's (2/4/2020) TurboTax update has fixed many of the problems with entering Spouse's Forms 1099-NEC. Delete any previously entered Forms 1099-NEC, then enter the Forms 1099-NEC under Self-employment income and expenses under the corresponding spouse's business.

Do not enter Forms 1099-NEC under Other Common Income. Entering under Other Common Income doesn't work at all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to add my wifes 1099-NEC in on here, but even though I select her as the recipient of the 1099...it has my name on the next page

Option 2 ... don't enter anything in the NEC section at all (since the IRS doesn't see what you put there other than the total) and use the OTHER SE income section instead ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to add my wifes 1099-NEC in on here, but even though I select her as the recipient of the 1099...it has my name on the next page

I’m using Turbo Tax for tax year 2020.

Also having the same issue today. I add my wife’s 1099 NEC and enter her info . I select on the radio button to clearly indicate it’s for her . When I’m done it picks me as the 1099 NEC recipient. So frustrating. I’m not liking the new format either . Always been a Turbo Taxer but not pleased this year . After 7 years I’ll think I’ll start using another service next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to add my wifes 1099-NEC in on here, but even though I select her as the recipient of the 1099...it has my name on the next page

Entering the Form 1099-NEC directly through a specific Schedule C will match the ownership of that Form 1099-NEC to the taxpayer who runs the Schedule C business.

Try going back to the section where you entered the Form 1099-NEC if you entered it on its own and delete that entry. Use these steps:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “1099-NEC” and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to 1099-NEC”

- Click on the blue “Jump to 1099-NEC” link

This will bring you to the summary of all Form 1099-NEC that you have entered. Click Delete or the trash can icon next to each one.

Next, you will re-enter the Form 1099-NEC as part of the Schedule C so that the income is reported directly as part of the Business Income and Expenses and within the correct form and section of your return.

Use these steps to go to the Schedule C section of your return.

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “schedule c” and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to schedule c”

- Click on the blue “Jump to schedule c” link

If you already have a Schedule C in your return, edit it and go to the section to Add Income. This is where you will re-enter the Form 1099-NEC.

If you do not already have a Schedule C in your return, follow the prompts and enter the information about your work/business for which you received the Form 1099-NEC. Then continue through that section to Add Income and enter the Form 1099-NEC plus any other income you received for that self-employed business.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a post