in Events

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Trying to Add a 1099 to my personal income - TurboTax forcing me to add it under a new business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to Add a 1099 to my personal income - TurboTax forcing me to add it under a new business

I assume this is a bug?

I've added several 1099 NECs to my business income. Now, I'm trying to add 1099 NECs under my social security number in Personal Income and it is forcing me to put it under a new business or an existing business. It's not tied to a business, it's tied to my social security number.

What's going on?

TurboTax Home & Biz 2021

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to Add a 1099 to my personal income - TurboTax forcing me to add it under a new business

A 1099-NEC is always business income (self-employment). It doesn't matter whether it's issued to your Social Security number or to an EIN. You personally and your sole proprietorship or single-member LLC business are one and the same. If the 1099-NEC is not related to the same business as your other 1099-NECs, then it is indeed for a separate business. What is the nature of your business, and what is the 1099-NEC for that you are trying to make "personal"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to Add a 1099 to my personal income - TurboTax forcing me to add it under a new business

I have 1099s tied to my social security and 1099s tied to my business TIN. This is the first time TurboTax is attempting to tie my SS based 1099s to my business TIN. This is the first time ever in decades of using TT that it's attempted to do that. Does that sound right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to Add a 1099 to my personal income - TurboTax forcing me to add it under a new business

It's a 1099 tied to my SS that has to do with network marketing sales, which has nothing to do with my business LLC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to Add a 1099 to my personal income - TurboTax forcing me to add it under a new business

@djlex2 wrote:

I have 1099s tied to my social security and 1099s tied to my business TIN. This is the first time TurboTax is attempting to tie my SS based 1099s to my business TIN. This is the first time ever in decades of using TT that it's attempted to do that. Does that sound right?

Yes, it sounds right. As I said above, if your business TIN is for a sole proprietorship or a single-member LLC, it makes no difference whether a 1099-NEC is issued to your Social Security number or to your business TIN. It's all business income to you.

Form 1099-NEC has only been in use for a few years, not decades, so whatever TurboTax does with it is obviously somewhat new.

Your business TIN is an EIN.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to Add a 1099 to my personal income - TurboTax forcing me to add it under a new business

@djlex2 wrote:

It's a 1099 tied to my SS that has to do with network marketing sales, which has nothing to do with my business LLC.

Then you have two separate businesses: a network marketing sales business, and whatever your LLC business is. It still makes no difference whether a 1099-NEC is has your SSN or your EIN on it. On your tax return you assign each 1099 to the business that the income is for, no matter what number is on the 1099.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to Add a 1099 to my personal income - TurboTax forcing me to add it under a new business

I get that the 1099 NEC is a new thing. But this is the first year TT has tied 1099s from the Personal section to the Business section.

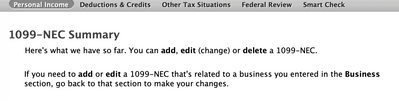

Furthermore, why would it attempt to distinguish between 1099 NECs entered in the Business Income section vs Personal Income section if it's going to tie them together anyway. Why would it tell me to go to the Business section to enter a 1099 that's related to a business if it's just going to tie it to a business? It seems like a either a bug, or bad interface design.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to Add a 1099 to my personal income - TurboTax forcing me to add it under a new business

To make matters worse, there is a bug in this interface as it doesn't allow you to pick an existing business it you fill in the prior field for "Describe the reason for this 1099-NEC".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to Add a 1099 to my personal income - TurboTax forcing me to add it under a new business

I may be reading into the term "business" too much. To me, that means an entity. And this would be the first year I've seen them manage it in such a fashion. It's a fairly big change.

Thanks for your replies. I appreciate it!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to Add a 1099 to my personal income - TurboTax forcing me to add it under a new business

This now creates a new problem. My wife has an LLC that gets paid, and the LLC pays her via 1099 to her social security. Now that it ties her Business Income to her personal income, it has DOUBLED the gross income. That can't be right.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to Add a 1099 to my personal income - TurboTax forcing me to add it under a new business

@djlex2 wrote:

This now creates a new problem. My wife has an LLC that gets paid, and the LLC pays her via 1099 to her social security. Now that it ties her Business Income to her personal income, it has DOUBLED the gross income. That can't be right.

This is an entirely separate issue. If your wife has a single-member LLC, the LLC can't pay her. The LLC IS her. A single-member LLC is a "disregarded entity." It is not treated as a separate entity. Your wife and her single-member LLC are one and the same as far as income tax is concerned. Saying that the LLC pays her is saying that she takes money out of her pocket and puts it back in the same pocket. You wouldn't report that or issue a 1099 for it. The income that her LLC receives is her income.

You and your wife are trying too hard to separate personal income and business income, or, as you said, you are reading too much into the word "business." An individual person can have business income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to Add a 1099 to my personal income - TurboTax forcing me to add it under a new business

@djlex2 wrote:

I may be reading into the term "business" too much. To me, that means an entity. And this would be the first year I've seen them manage it in such a fashion. It's a fairly big change.

Thanks for your replies. I appreciate it!

Your ongoing business activities make it a business, not a particular legal structure. It sounds like you have two separate businesses with different activities and income streams, one of which is organized as a single member LLC and the other is an unorganized sole proprietorship. You need two schedule Cs on your tax return, one for each business activity.

Your spouse also needs a schedule C for her LLC (if it is a single member LLC) so if you are filing jointly, you will have 3 total Schedule Cs attached to your 1040.

No one here can see your return so we can't see if you have done something wrong to cause your income to double. You may need to clear and start over or contact customer support who can do a screen share with you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to Add a 1099 to my personal income - TurboTax forcing me to add it under a new business

@djlex2 wrote:

This now creates a new problem. My wife has an LLC that gets paid, and the LLC pays her via 1099 to her social security. Now that it ties her Business Income to her personal income, it has DOUBLED the gross income. That can't be right.

Your wife's LLC should not issue a 1099 to her for money she withdraws.

Background: LLCs are creations of state law, the IRS does not recognize them as different kinds of entities. To the IRS, a single member LLC is a disregarded entity, the same as an unorganized sole proprietorship. The person is the company and the company is the person, they are the same thing. The LLC can't pay the member as an employee or as a subcontractor. (Jane's LLC could pay John as a subcontractor if John did work for the business, instead of making John a partner, but Jane's LLC can't pay Jane.)

An LLC with more than one member is treated by the IRS as a partnership and must file a separate partnership return.

So you need to cancel the 1099 issued by Jane's LLC to Jane the person. The LLC and the person are the same thing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to Add a 1099 to my personal income - TurboTax forcing me to add it under a new business

May I ask.....is this the first time using the Home & Business version? It just has a separate tab for Business but it's all your personal income and goes on Schedule C in your personal return. Just enter the 1099NEC under the Business tab.

And actually you can just enter it as Other self employment income or as Cash or General income. You don't need to get a 1099NEC or 1099Misc or 1099K. Even if you did you can enter all your income as Cash. Only the total goes to schedule C.

You said.......It's not tied to a business, it's tied to my social security number. But it is your own business. When you are self employed you are in business for yourself. You don't have to have an official business set up. You use your own info. The people or company that pays you is your customer or client. You are considered to have your own business for it. YOU are the business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to Add a 1099 to my personal income - TurboTax forcing me to add it under a new business

"YOU are the business."

It's called sole proprietorship.

Still you need to file Schedule C.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Raph

Community Manager

Raph

Community Manager

in Events

Raph

Community Manager

in Events

Raph

Community Manager

in Events

Raph

Community Manager

in Events