- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Took RMD from inherited ira in 2020 then rolled the contribution back in because of the cares act. Received a 1099-r for the distribution. Howto add rollover back in?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Took RMD from inherited ira in 2020 then rolled the contribution back in because of the cares act. Received a 1099-r for the distribution. Howto add rollover back in?

Thank you, I think I tried this, so I'll try again. I guess it would be easy to demonstrate what really happened here if I'm challenged by the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Took RMD from inherited ira in 2020 then rolled the contribution back in because of the cares act. Received a 1099-r for the distribution. Howto add rollover back in?

The answer to that question is not for the tax return, it is for TurboTax to prevent rolling over an inherited IRA that is not normally allowed. It is totally internal to TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Took RMD from inherited ira in 2020 then rolled the contribution back in because of the cares act. Received a 1099-r for the distribution. Howto add rollover back in?

Can not get the screen asking about rollover. So cannot remover the rolled over amount from taxable income.

Why not.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Took RMD from inherited ira in 2020 then rolled the contribution back in because of the cares act. Received a 1099-r for the distribution. Howto add rollover back in?

@SBLighterink wrote:

Can not get the screen asking about rollover. So cannot remover the rolled over amount from taxable income.

Why not.

Delete the 1099-R you entered and re-enter.

Answer the RMD question that "None of this distribution was a RMD" or"RMD not required" depending on the TurboTax version - because it was NOT a RMD, there were no 2020 RMD's.

If this is an inherited IRA then answer the "Is this IRA inherited" with NO. The purpose of that question is to PREVENT rolling an inherited IRA over, but ti is allowed for 2020 only.

Then you will get the screen to say it was "moved" and all rolled over.

That will put the 1099-R box 1 amount on the 1040 form line 4a with the word ROLLOVER next to it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Took RMD from inherited ira in 2020 then rolled the contribution back in because of the cares act. Received a 1099-r for the distribution. Howto add rollover back in?

I deleted the first entry of the inherited IRA and reentered it, but still did not get a screen to show that I rolled it back in. I have been entering this IRA as inherited since 2009 returns. Won't this trigger something with the IRS if it is not entered that way this year and then back to inherited next year? I am using the Home & Business Version. Shouldn't Turbotax be fixed so that the people who paid for the software don't have to enter it wrong to get it to work right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Took RMD from inherited ira in 2020 then rolled the contribution back in because of the cares act. Received a 1099-r for the distribution. Howto add rollover back in?

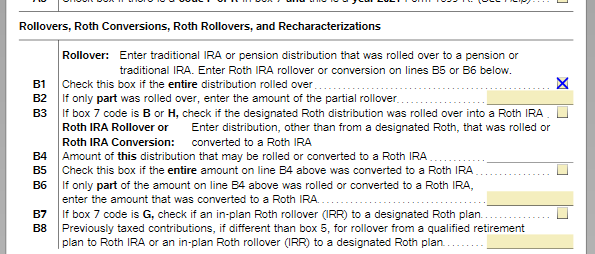

Enter the 1099R as received. To show the rollover you need to go into Forms mode to check the box its was a rollover back into the plan.

- Select "Forms" in the upper right hand corner of the screen

- In the left hand column select the 1099R you are working on.

- Scroll down the screen. Review your RMD answer.

- Continue to scroll down to the Rollover, Conversions, Recharacterizations section

- Check box indicating it was a rollover.

- In the left column select 1040 to review the amount was not taxable.

Select "Step by Step" in upper right hand corner of screen to return to interview mode.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Took RMD from inherited ira in 2020 then rolled the contribution back in because of the cares act. Received a 1099-r for the distribution. Howto add rollover back in?

I followed this suggestion and marked the Rollover box on the 1099R form. BUT, when I returned to the 1040, the amount was still listed as income. I went back to the 1099R form and under the inherited section I marked the box "treat it as recipient's own (this is treated as a rollover)" I did not change Box 7 from 4. When I went back to form 1040, the amount of the distribution was included in ROLLOVER amount. Hope this helps someone else.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tianwaifeixian

Level 4

tcondon21

Returning Member

kgsundar

Level 2

kgsundar

Level 2

xhxu

New Member