- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Tax for foreign pension

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax for foreign pension

I am a US citizen, residing in US. I receive a monthly pension from Romanian government for the work done prior to my coming to the US. I use TurboTax Premier to file my return. Do I need to report this pension, and if yes, how?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax for foreign pension

You do need to report the income as pension income, assuming there is not a tax treaty exempting it. You need to enter a substitute 1099-R form in TurboTax as follows:

- Choose the Federal option on your left menu bar

- Choose Wages & Income

- Choose the Retirement Plans and Social Security menu option

- Choose IRA, 401(k), Pension Plan Withdrawals(1099-R)

- Choose the enter 1099-R option

- Choose Change how I enter my form

- Choose Type it in myself

- Choose Financial institution or other provider (1099-R)

- Enter in as much information as you can regarding the pension income

- Work through that section until you see Do any of these situations apply to you?

- Choose I need to file a substitute 1099-R

- Complete the information requested

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax for foreign pension

You do need to report the income as pension income, assuming there is not a tax treaty exempting it. You need to enter a substitute 1099-R form in TurboTax as follows:

- Choose the Federal option on your left menu bar

- Choose Wages & Income

- Choose the Retirement Plans and Social Security menu option

- Choose IRA, 401(k), Pension Plan Withdrawals(1099-R)

- Choose the enter 1099-R option

- Choose Change how I enter my form

- Choose Type it in myself

- Choose Financial institution or other provider (1099-R)

- Enter in as much information as you can regarding the pension income

- Work through that section until you see Do any of these situations apply to you?

- Choose I need to file a substitute 1099-R

- Complete the information requested

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax for foreign pension

Thank you Thomas.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax for foreign pension

This substitue 1099-R doesn't work as it rejected without the ETIN. I don't have a ETIN as the company is from UK. I tired to put a dummy number (i.e 11-1111111, 99-9999999) and it doen't work. Please advise. Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax for foreign pension

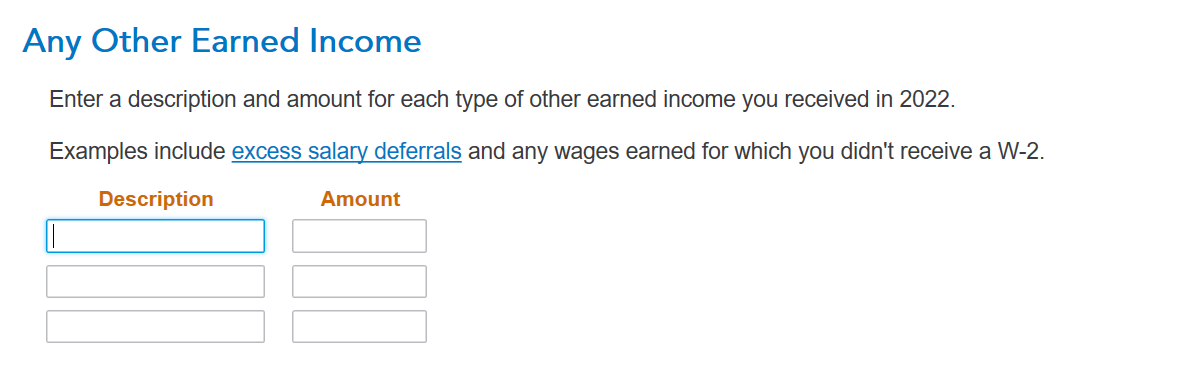

In that case, try entering the income under Miscellaneous income as follows:

- To your left, select Federal

- From the top, select Wages and Income

- Scroll down to last section -Less Common Income -select Miscellaneous Income, 1099-A, 1099-C- Start

- Next screen, scroll down to Other Reportable Income- Start

- Follow prompts

For more detail see HERE

Enjoy the rest of your day!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

msweeney8479

New Member

HrlyRdKg08

New Member

user17695427596

New Member

ccoleary

New Member

user17692770492

Level 1