- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Simple Indirect Rollover - no RMD, no backdoar Roth, no complications

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Simple Indirect Rollover - no RMD, no backdoar Roth, no complications

I took a distribution and returned it within the 60 days to qualify for not incurring a tax penalty. This is a classic case. Yet there is no place to enter this information within TurboTax Deluxe.

My IRA provider Schwab, filled out the 1099-R including this distribution as Gross Distribution and Taxable Amount. Was that a mistake? Should I just subtract out the amount that was returned within the 60 Days, from the Taxable Amount, with the Form 5498 as back-up but not filed?

Or should I put the amount that I paid back in as a contribution that would properly null out the amount distributed. But in the IRA Contributions section, TurboTax specifically states to NOT use this section for rollovers.

So, how do I get this amount distributed to be subtracted from my taxable income within TurboTax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Simple Indirect Rollover - no RMD, no backdoar Roth, no complications

If it was within the 60 days, after you enter the 1099R it will ask what you did with it. Pick you moved the money to another account even if you put it back into the same account. Then that will expand and you pick I rolled over all this money. Then it will expand to enter how much you rolled over.

Did they take any withholding out of it? If they did you had to add it back in from your own money when you put it back or the withholding will become a distribution by itself.

If you are looking at a summary screen or review screen those show the full amount as income and lump a lot of stuff together. You need to check the actual 1040 form and make sure it's right. Check lines 4b & 5b for any taxable amounts. For a rollover line b should be zero and the word Rollover by it.

Log into TurboTax and bring up the 1099-R that you posted.

Continue in the interview

Do any of these situations apply to you? - None of these apply

How much of the $XX,XXX was a RMD? - None

Tell us if you moved the money through a rollover or conversion

I rolled over some or all of it to an IRA or other retirement account within the time limits (normally 60 days)

Did you roll over all of this $XX,XXX (Box 1) to another retirement account?

Yes, I rolled over $XX,XXX to another traditional IRA or retirement account (or returned it to the same account).

Complete the interview.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Simple Indirect Rollover - no RMD, no backdoar Roth, no complications

If it was within the 60 days, after you enter the 1099R it will ask what you did with it. Pick you moved the money to another account even if you put it back into the same account. Then that will expand and you pick I rolled over all this money. Then it will expand to enter how much you rolled over.

Did they take any withholding out of it? If they did you had to add it back in from your own money when you put it back or the withholding will become a distribution by itself.

If you are looking at a summary screen or review screen those show the full amount as income and lump a lot of stuff together. You need to check the actual 1040 form and make sure it's right. Check lines 4b & 5b for any taxable amounts. For a rollover line b should be zero and the word Rollover by it.

Log into TurboTax and bring up the 1099-R that you posted.

Continue in the interview

Do any of these situations apply to you? - None of these apply

How much of the $XX,XXX was a RMD? - None

Tell us if you moved the money through a rollover or conversion

I rolled over some or all of it to an IRA or other retirement account within the time limits (normally 60 days)

Did you roll over all of this $XX,XXX (Box 1) to another retirement account?

Yes, I rolled over $XX,XXX to another traditional IRA or retirement account (or returned it to the same account).

Complete the interview.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Simple Indirect Rollover - no RMD, no backdoar Roth, no complications

VolvoGirl,

Thank you very much! This was a perfect! It worked! The key for me was when you said "it will ask what you did with it." I did not know that this question related to an indirect rollover because of the wording "Moved the money to another retirement account", which I definitely did not do. Yet, it opens the dialog as you describe, which enabled me to fix this.

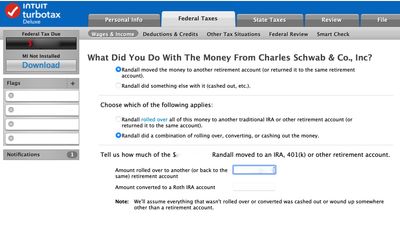

I attached a photo below, with PII redacted, showing the first question and how it expands into subsequent questions where the proper info can be added to cover the indirect rollover.

For the record, I returned the money within the 60 days and no, Schwab did not withhold any money.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Rmille10

Level 2

dariow

Returning Member

zugzwang

New Member