- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Reced a 1099 for amount bank wrote off for my car. I understand I will only owe tax I only gave Survivors Social Security each month.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reced a 1099 for amount bank wrote off for my car. I understand I will only owe tax I only gave Survivors Social Security each month.

Benefits

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reced a 1099 for amount bank wrote off for my car. I understand I will only owe tax I only gave Survivors Social Security each month.

If your only income is this 1099-C and Social Security income, you may not need to file a tax even though it is taxable income.

Whether you need to file depends on your filing status and your taxable income.

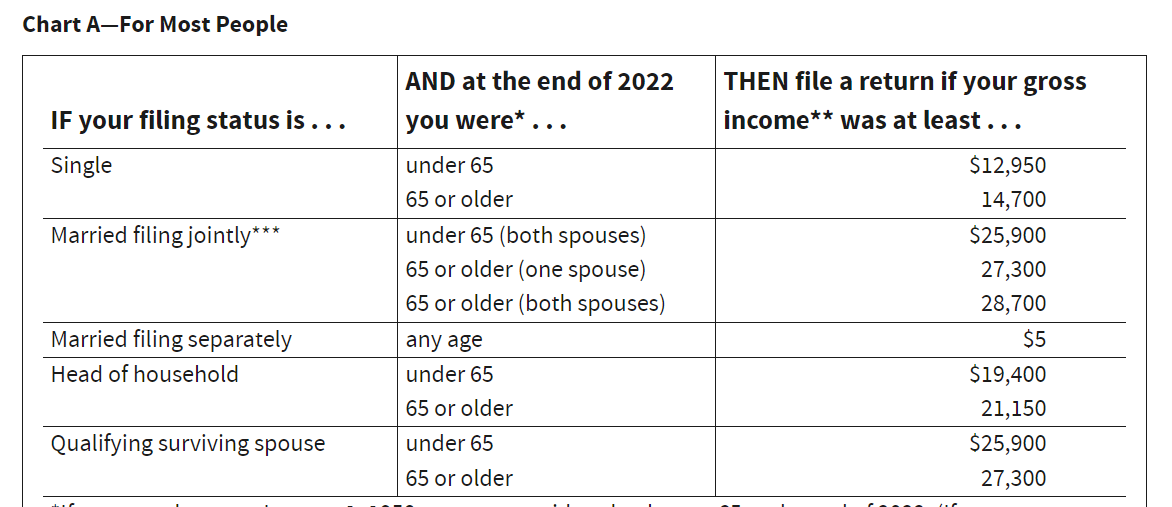

Use the chart below to find the line that matches your filing status and age. If your income is less than the amount listed on that line, you don't have to file because you will not owe any taxes.

If you do need to file, this is how to enter your 1099-C:

- Open your return and select Federal on the left side menu.

- Select Income & Expenses.

- Scroll down the list and find the section called, Less Common Income, expand the section.

- Scroll all the way down and select Miscellaneous Income, 1099-A, 1099-C, click Start to the right.

- Click Start to the right of Cancelation of debt (Form 1099-C) or the abandonment and/or acquisition of secured property (Form 1099-A).

- Answer the questions and enter the information from your 1099-C.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

srobinet1

Returning Member

jcharlemagnej

New Member

Christine51

Level 1

louannwells

New Member

fklpsru271

Returning Member