- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: You will enter the 1099R exactly as you received it and t...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part of my IRA distribution was contributed directly to a qualifying charity. Only the total distribution is shown on my 1099R. how do I enter the QCD in Turbo Tax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part of my IRA distribution was contributed directly to a qualifying charity. Only the total distribution is shown on my 1099R. how do I enter the QCD in Turbo Tax?

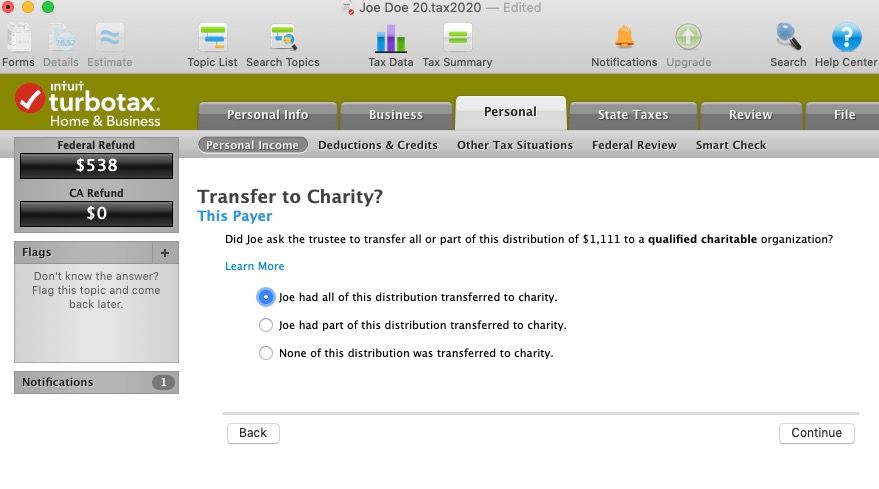

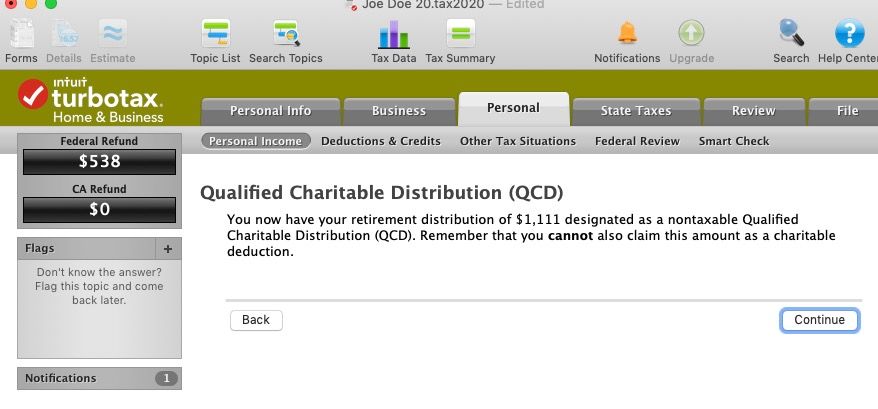

You will enter the 1099R exactly as you received it and then in the questions that follow, if this is RMD it will ask if had a QCD and then you enter the amount of the QCD and the 1099R will then not be added to taxable income.

You also however cannot take a charitable contribution for the QCD.

To enter pension and annuity Payments (1099-R)

• Click on Federal Taxes

• Click on Wages and Income

• Click on I'll choose what I work on (if shown)

• Scroll down to Retirement Plans and Social Security

• On IRA, 401(k), Pension Plan Withdrawals (1099-R), click the start or update button

The QCD questions will come up after the 1099R entry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part of my IRA distribution was contributed directly to a qualifying charity. Only the total distribution is shown on my 1099R. how do I enter the QCD in Turbo Tax?

You will enter the 1099R exactly as you received it and then in the questions that follow, if this is RMD it will ask if had a QCD and then you enter the amount of the QCD and the 1099R will then not be added to taxable income.

You also however cannot take a charitable contribution for the QCD.

To enter pension and annuity Payments (1099-R)

• Click on Federal Taxes

• Click on Wages and Income

• Click on I'll choose what I work on (if shown)

• Scroll down to Retirement Plans and Social Security

• On IRA, 401(k), Pension Plan Withdrawals (1099-R), click the start or update button

The QCD questions will come up after the 1099R entry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part of my IRA distribution was contributed directly to a qualifying charity. Only the total distribution is shown on my 1099R. how do I enter the QCD in Turbo Tax?

Do you know when turbo deluxe will be updated to ask the question about contribution to charity for 2020 assuming one is 70 1/2?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part of my IRA distribution was contributed directly to a qualifying charity. Only the total distribution is shown on my 1099R. how do I enter the QCD in Turbo Tax?

If you mean a QCD from an IRA distribution - that is in the program now.

Qualified charitable distributions.

A qualified charitable distribution (QCD) generally is a nontaxable distribution made directly by the trustee of your IRA (other than a SEP or SIMPLE IRA) to an organization eligible to receive tax-deductible contributions. You must be at least age 70½ when the distribution was made. Also, you must have the same type of acknowledgment of your contribution that you would need to claim a deduction for a charitable contribution.

If you are 70 1/2 or older, the interview will ask if you took the RMD. After that it will ask if you make a charitable contribution. Answer yes and then enter the QCD amount.

The 1099-R box 1 amount will go in the 1040 form line 4b (taxable amount) minus the QCD amount and the total box 1 amount will go on line 4a with "QCD" next to it.

Enter a 1099-R here:

Federal Taxes,

Wages & Income

(I'll choose what I work on - if that screen comes up)

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R).

OR Use the "Tools" menu (if online version left side) and then "Search Topics" for "1099-R" which will take you to the same place.

Be sure to choose which spouse the 1099-R is for if this is a joint tax return.

Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R.

[NOTE: When you get to the "Your 1099-R Entries" screen where you can add another 1099-R, use "continue" to keep going as there are additional interview questions after that screen in most cases. You can always return as shown above.]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part of my IRA distribution was contributed directly to a qualifying charity. Only the total distribution is shown on my 1099R. how do I enter the QCD in Turbo Tax?

2019 version asks question but not yet 2020 in interview process.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part of my IRA distribution was contributed directly to a qualifying charity. Only the total distribution is shown on my 1099R. how do I enter the QCD in Turbo Tax?

Sure it does. Make sure you have applied the latest (Dec 22) update.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part of my IRA distribution was contributed directly to a qualifying charity. Only the total distribution is shown on my 1099R. how do I enter the QCD in Turbo Tax?

This is for Deluxe.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part of my IRA distribution was contributed directly to a qualifying charity. Only the total distribution is shown on my 1099R. how do I enter the QCD in Turbo Tax?

Edit the 1099-R go thru all the questions after the main form again, and make sure the IRA/SEP/Simple box is checked on the main form (it had to be from an actual IRA-type account, not form a 401k or 403b or 457 )

(If you turned 70.5 in 2020, someone will have to check to see if the program is set to trigger the QCD since the normal RMD started to be age 72 in 2020 and QCD is still allowed after 70.5, even if normal RMD is now 72 for some people )

________________________

Deluxe "should" work the same as the other versions...as long as you have the latest update. IF not, try again in a couple weeks..... after you apply the next software update....might not be until the end of the week of 4 Jan

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part of my IRA distribution was contributed directly to a qualifying charity. Only the total distribution is shown on my 1099R. how do I enter the QCD in Turbo Tax?

I think that is the answer to wait for the update. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part of my IRA distribution was contributed directly to a qualifying charity. Only the total distribution is shown on my 1099R. how do I enter the QCD in Turbo Tax?

As of 1/30/2021 I am still not seeing a fix to trigger the QCD questions at 70.5 when I am not yet to the RMD age (72).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part of my IRA distribution was contributed directly to a qualifying charity. Only the total distribution is shown on my 1099R. how do I enter the QCD in Turbo Tax?

Yeah...still a bug in the software for anyone just hitting age 70.5 in 2020 who did a QCD form an IRA account......read this:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part of my IRA distribution was contributed directly to a qualifying charity. Only the total distribution is shown on my 1099R. how do I enter the QCD in Turbo Tax?

Still a bug in the Deluxe version. I can change my birthdate to 1049 and it will work. I am surprised they have not got this fixed yet!!!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part of my IRA distribution was contributed directly to a qualifying charity. Only the total distribution is shown on my 1099R. how do I enter the QCD in Turbo Tax?

Only check for the fix on Fridays. Software updates are usually Wed or Thursday evenings...and only rarely any other days.

(there is a workaround for those who are desperate to enter it right now...but I'm a bit leery that the QCD result of the workaround will remain correctly once the fix is enabled.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part of my IRA distribution was contributed directly to a qualifying charity. Only the total distribution is shown on my 1099R. how do I enter the QCD in Turbo Tax?

OK that worked for the qcd from my IRA, but when I entered the data for my wife's IRA and the RMD that was taken there was no follow-up question about the qcd.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part of my IRA distribution was contributed directly to a qualifying charity. Only the total distribution is shown on my 1099R. how do I enter the QCD in Turbo Tax?

I should mention that my wife's IRA was inherited from her dad, so she has taken RMDs from it in earlier years also. Last year the CARES act meant she did not have to take an RMD from this IRA, but we withdrew funds as QCDs for two charities we wanted to support. So we did get a 1099-R showing all the QCD money as "taxable."

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

djhi849711

New Member

giad429273

New Member

moehf74

New Member

lrobertsgandy

New Member

berbellsc

New Member