- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Where do I enter 1099-NEC income? The program wont give me a straight answer. Are we waiting ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099-NEC income? The program wont give me a straight answer. Are we waiting for an update?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099-NEC income? The program wont give me a straight answer. Are we waiting for an update?

Form 1099-NEC new way to report self-employment income instead of Form 1099-MISC. Please follow these steps to enter your 1099-NEC income:

- Login to your TurboTax Account

- Click on the Search box on the top and type “self employed income" (use this exact phrase)

- Click on “Jump to self employed income ”

- Continue answering questions until "Let's enter the income for X work" screen and select "Form 1099-NEC"

Please see What is Form 1099-NEC? if you want to learn more about the new form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099-NEC income? The program wont give me a straight answer. Are we waiting for an update?

I'm using the 2020 Home & Business CD. I don't see a place for 1099-NEC, just 1099-MISC. Where do you enter a 1099-NEC?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099-NEC income? The program wont give me a straight answer. Are we waiting for an update?

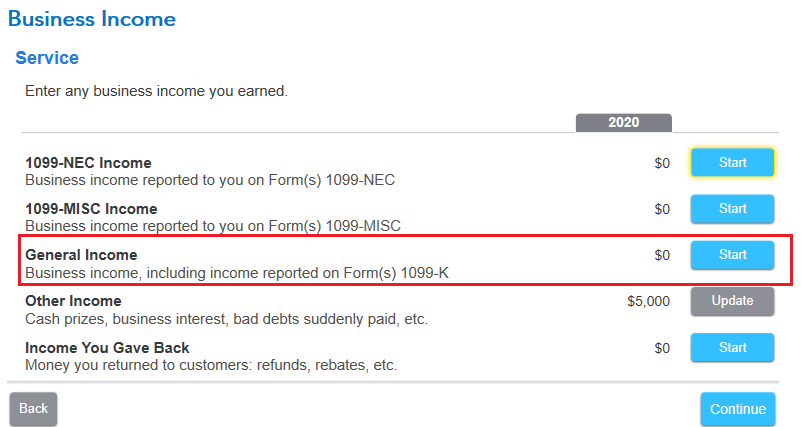

Same place as the 1099-Misc. Make sure your software is up to date. You can do this by clicking "Online" in the top menu bar then "Check for Updates". Under the "Business and Income" screen Start Business Income. There you will see the input for the 1099-NEC Start. Continue through the screens to enter the 1099-NEC.

The 1099-NEC is a new form for the 2020 tax year. The NEC represents Non Employee Compensation and will be used for business payments to individuals going forward.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099-NEC income? The program wont give me a straight answer. Are we waiting for an update?

When I log into TurboTax and type what you said to type in the search bar, I get no "jump to" response. Am I in the wrong place?

Edit: I got there

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099-NEC income? The program wont give me a straight answer. Are we waiting for an update?

So how do I get to that place when I'm not using TT online? John

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099-NEC income? The program wont give me a straight answer. Are we waiting for an update?

The search and Jump to link is still available in TurboTax Desktop.

- Click on the Search (far right in the menu bar) on the top and type “1099-NEC (use the dash)"

- Click on “Jump to 1099-nec"

- Continue answering questions until "Let's enter the income for X work" screen and select "Form 1099-NEC"

Continue to enter your information. You can also choose to enter the income as cash in your business entry. The form entry is not required by the IRS, only that all income is reported that was collected. Whichever method you choose keep the form with your other tax records.

See the image below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

YT76

Level 2

AZCigarman

New Member

epbellon

New Member

trayva3

New Member

stelr

Level 1