- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Turbotax silently ignores entry of "Value of your traditional IRA" and does not allow direct entry into "IRA Info Wks"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax silently ignores entry of "Value of your traditional IRA" and does not allow direct entry into "IRA Info Wks"

When filling out a 1099-R for a traditional IRA distribution in TurboTax Desktop TY2022, there is usually an entry that asks one to "enter the value of your traditional IRA" from the end of the previous year (in this case 2022).

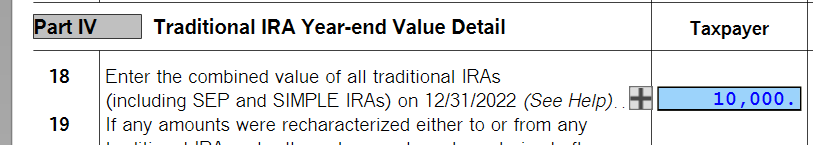

This value is supposed to go onto Line 18 of the Federal "IRA Information Worksheet", which is shown in the forms list as "IRA Info Wks".

TTax is ignoring the value that I enter, setting it to zero, and putting that into Line 18. It will also not allow an override of Line 18 to the correct value.

Has anyone else seen this? Is it a TTax bug (surely not!)? Is there some other source for the information that needs to be modified, instead?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax silently ignores entry of "Value of your traditional IRA" and does not allow direct entry into "IRA Info Wks"

To verify, you have entered your Form 1099-R and entered a value in the follow-up questions but it put $0 on line 18 of the "IRA Info Wks"? I cannot recreate the issue.

Please review these steps:

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Click "Continue", enter the information from your 1099-R, and answer all follow-up questions.

- On the "Review your 1099-R info" screen click "Continue"

- Answer "yes" to "Any nondeductible Contributions to your IRA?" if you had any nondeductible contributions in prior years.

- Answer the questions about the basis from line 14 of your 2021 Form 8606 and the value of all traditional, SEP, and SIMPLE IRAs

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax silently ignores entry of "Value of your traditional IRA" and does not allow direct entry into "IRA Info Wks"

It turns out that although one cannot override Line 18 of the IRA Info Wks directly (i.e. via Ctrl-D), one can do so by providing supporting details (i.e. via Ctrl-I). Entering information in the details that changes the final result is accepted.

Whether or not it will break electronic filing, I don't know yet (over-rides often do). I will update this when I file.

The weird thing is, this value is really important if your IRA that had non-qualifying contributions (i.e. if at least one contribution to the IRA was NOT deducted on that year's taxes). Once entered, the calculation seems correct (it affects the amount of an IRA distribution that is taxed). However, TTax is not correctly capturing this number, even when it is queried for and provided.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax silently ignores entry of "Value of your traditional IRA" and does not allow direct entry into "IRA Info Wks"

Hi, thanks for the response.

I don't see any of this, starting with the search bar at the upper right. My search at the upper right takes me to some pretty useless help, not something useful like the forms. I'm using Desktop, are you looking at Online?

Anyway, I don't want to waste your time; I have a work-around. I have to do other things now, but will come back later and lay out what I see.

Thank you for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax silently ignores entry of "Value of your traditional IRA" and does not allow direct entry into "IRA Info Wks"

Please see these different steps in TurboTax Desktop to get to the questions during the interview if needed:

- Click "Federal Taxes" on the top and select "Wages & Income"

- Click "I'll choose what to work on"

- Scroll down and click "Start" next to "IRA, 401(k), Pension Plan (1099-R)"

- Answer "Yes" to the question "Did You Have Any of These Types of Income?"

- Click "I'll Type it Myself"

- Choose "Form 1099-R, Withdrawal of Money from 401(k) Retirement Plans, Pensions, IRAs, etc."

- Click "Continue" and enter the information from your 1099-R

- On the "Your 1099-R Entries" screen click "continue"

- Answer "yes" to "Any nondeductible Contribution to your IRA?" if you had any nondeductible contributions in prior years.

- Answer the questions about the basis from line 14 of your 2021 Form 8606 and the value of all traditional, SEP, and SIMPLE IRAs

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax silently ignores entry of "Value of your traditional IRA" and does not allow direct entry into "IRA Info Wks"

Hi, DanaB27, thanks for the help.

Following along, I finished step 8) On the "Your 1099-R Entries" screen click "continue"

8.1) I then get "Did XXX inherit the IRA from YYY?" --> answer NO

8.2) "What did you do with the money from YYY?" --> a) moved it to another retirement account, or b) did something else with it, e.g. cashed it out. --> answer "did something else with it"

8.3) "Did you put this money in an HSA?" --> NO

8.4) It returns to the list of "Your 1099-R Entries" --> Continue

8.5) "Did you take any disaster distributions?" --> NO

9) "Any non-deductible contributions?" --> YES

10) "Find the IRA Basis" --> the basis is correct because carried forward from TTax last year --> Continue

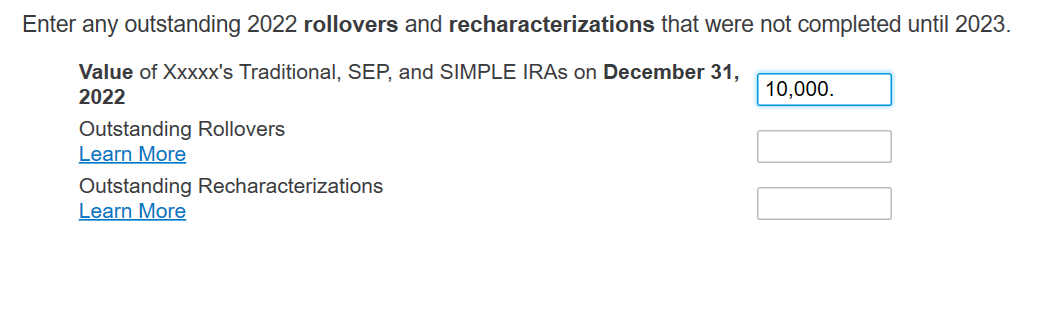

10.1) "Tell us the Value of your Traditional IRA" --> entered (NOTE that Line 18 does NOT update at this time in the "IRA Info Wks")

10.2) Check for RMDs --> received the complete RMD --> Continue --> back to Income Summary

11) At this point, the correct IRA value from 12/31/22, entered in 10.1 above, is NOT in "IRA Info Wks" line 18, but it definitely should be, as it makes a great deal of difference to the final tax.

Thanks, DanaB27, for your help! Let me know if this might be a bug where you want me to upload the file. Otherwise, I'm okay for now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax silently ignores entry of "Value of your traditional IRA" and does not allow direct entry into "IRA Info Wks"

Yes, it would be helpful to have a TurboTax ".tax2022" file that is experiencing this issue. You can send us a “diagnostic” file that has your “numbers” but not your personal information.

If you would like to do this, here are the instructions for TurboTax Download:

- On your menu bar at the very top, click "Online"

- Select "Send Tax File to Agent"

- Click "Send"

- The pop-up will have a token number

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

The instructions for TurboTax Online:

- From the left menu select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen and then you will get a Token number.

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

We will then be able to see exactly what you are seeing and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax silently ignores entry of "Value of your traditional IRA" and does not allow direct entry into "IRA Info Wks"

Token 1074933

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax silently ignores entry of "Value of your traditional IRA" and does not allow direct entry into "IRA Info Wks"

Thank you, I reviewed your token. I noticed when I tried to edit the value on the "Tell us the Value of your Traditional IRA" screen a "Supporting Detail" window popped up. When I deleted it, I was able to enter a value and it would carry to the "IRA Information Worksheet" line 18.

If this doesn't solve your problem then please make sure that your software is updated. Please see

How do I update my TurboTax CD/Download software program?.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tcondon21

Returning Member

shehires

New Member

cherylnaamani

New Member

MM18

Level 1

in [Event] Ask the Experts: Investments: Stocks, Crypto, & More

simoneporter

New Member