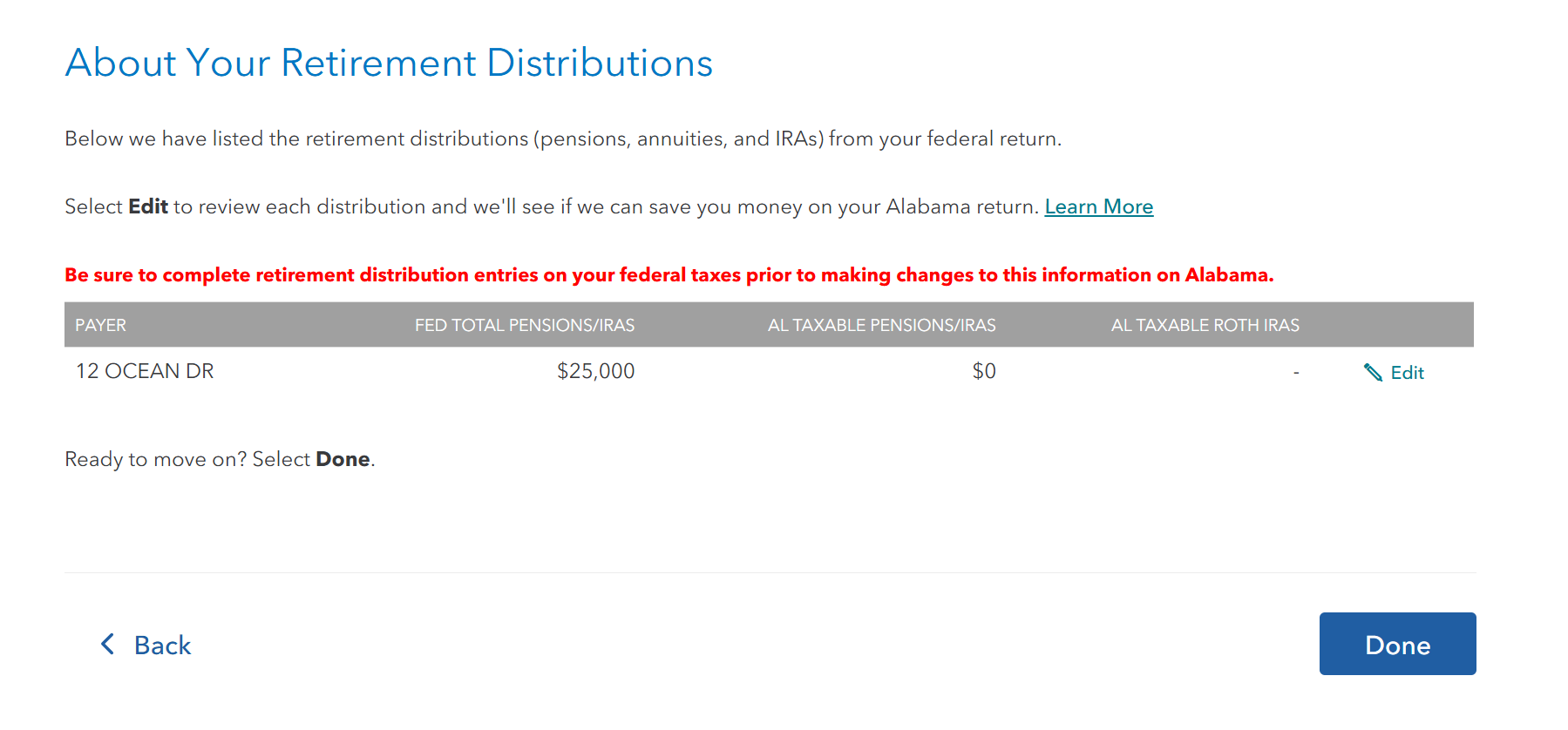

In the Alabama section of TurboTax, on the About Your Retirement Distributions. you must enter information by Edit by your Military Retirement Pay.

Alabama Special Handling of This Distribution Select Yes

Reason for Exempt Distribution select Military Retirement Pay from Dropdown.

On the About Your Retirement Distributions, select Done

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"