- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Is the 1099-R from OPM?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I receive a 1099R statement of Survivor Annuity paid Box 2a on my survivor annuity shows UNKNOWN AS TAXABLE AMOUNT what amount should it be

OPM violates the 1099-R rules by writing "helpful" information in the box rather than just the value or code like they are supposed to. OPM has done that for years and it causes more confusion than help. They put UNKNOWN in box 2a when it should be blank, and put "7 NONDISABILITY" in box 7 when is should only be "7", "1" or "2".

The taxable amount in box 2a is usually the box 1 amount unless you have after-tax contributions in the retirement plan and use the simplified method. If this is NOT the first year of receiving payments, then you should use the same method that was used last year - either the box 1 amount of the simplified method, using the carry forward simplified information from last year.

If box 2a is blank or UNKNOWN then there should be amount in box 9b to use with the simplified method. If no amount in 9b then contact OPM to find the account "basis".

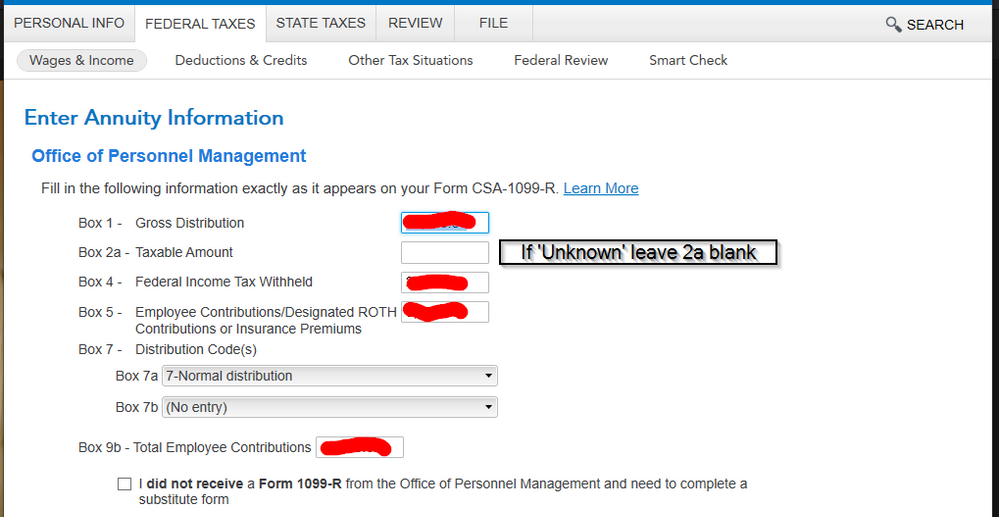

Enter a 1099-R here:

Federal Taxes,

Wages & Income

I’ll choose what I work on (if that screen comes up),

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R).

OR Use the "Tools" menu (if online version under My Account) and then "Search Topics" for "1099-R" which will take you to the same place.

Be sure to choose which spouse the 1099-R is for if this is a joint tax return.

Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R.

[NOTE: When you get to the "Your 1099-R Entries" screen where you can add another 1099-R, use "continue" to keep going as there are additional interview questions after that screen in most cases. You can always return as shown above.]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I receive a 1099R statement of Survivor Annuity paid Box 2a on my survivor annuity shows UNKNOWN AS TAXABLE AMOUNT what amount should it be

@ChampChiranand anybody else who wants to chime in.

I have gotten here by the rabbit hole.

My 2017 box 2a states unknown. So that means the Simplified method for a 12 month time frame. I even created a spread sheet for the next two years.

But my 2016 OPM 1099-r states the starting date of 06/01/2016. The box 2a has an amount in it. So I assumed the Simplified method starts in 2017 with no previous year recovery amount (0) for line 6.

But my concern is the later 6 months of 2016. If the box 2a has an amount am I to assume that 2016 is not included in the Simplified method worksheet and that box2a taxable amount is already correct?

I assume that the blank amount in box2a triggered the Simplified Method in TurboTax?

I hope I made this clear. I could have started a new question but it ties in here so clearly.

Thank you in advance.

I would really like to finish up at a decent hour. 8-)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I receive a 1099R statement of Survivor Annuity paid Box 2a on my survivor annuity shows UNKNOWN AS TAXABLE AMOUNT what amount should it be

@phyzx wrote:

@ChampChiranand anybody else who wants to chime in.

I have gotten here by the rabbit hole.

My 2017 box 2a states unknown. So that means the Simplified method for a 12 month time frame. I even created a spread sheet for the next two years.

But my 2016 OPM 1099-r states the starting date of 06/01/2016. The box 2a has an amount in it. So I assumed the Simplified method starts in 2017 with no previous year recovery amount (0) for line 6.

But my concern is the later 6 months of 2016. If the box 2a has an amount am I to assume that 2016 is not included in the Simplified method worksheet and that box2a taxable amount is already correct?

I assume that the blank amount in box2a triggered the Simplified Method in TurboTax?

I hope I made this clear. I could have started a new question but it ties in here so clearly.

Thank you in advance.

I would really like to finish up at a decent hour. 8-)

I suggest that you discuss this with the pension department at OPM. The simplified method is used to recover the tax free contributions that you made and are part of every monthly payment. If you have an unrecovered after-tax "basis" then you should have used the simplified method starting with the very first payment. You should ask them why the 2016 had a taxable amount and 2017 does not (it might have something to do with a part year pension, but only OPM can tell you their rules). They should also be able to tell you what start date to use.

See IRS Pub 971page 5 for information.

https://www.irs.gov/pub/irs-pdf/p721.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I receive a 1099R statement of Survivor Annuity paid Box 2a on my survivor annuity shows UNKNOWN AS TAXABLE AMOUNT what amount should it be

I contact OPM and get this repeated dribble.

If your annuity started after July 2, 1986, a portion of each annuity payment is taxable and a portion is a tax-free return of your contributions to the retirement fund. Your retirement contributions are shown on the 1099R form we send you each January for tax filing purposes.

To assist you in determining the tax-free portion of your annuity, the Internal Revenue Service (IRS) offers Publication 721, "Tax Guide to U.S. Civil Service Retirement Benefits". This publication is available at https://www.irs.gov/pub/irs-pdf/p721.pdf

This info is what I read before that sent me down this rabbit hole. This is not an adequate answer.

The search for an I.R.S. and O.P.M. knowledgeable person is now underfoot. If anybody has links I would appreciate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I receive a 1099R statement of Survivor Annuity paid Box 2a on my survivor annuity shows UNKNOWN AS TAXABLE AMOUNT what amount should it be

You need to actually talk to someone at OPM who can access your account and look up and figure out what that amount on your 1099-R should be and issue a revised 1099-R if necessary.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I receive a 1099R statement of Survivor Annuity paid Box 2a on my survivor annuity shows UNKNOWN AS TAXABLE AMOUNT what amount should it be

I actually used the simplified method worksheet to validate the entries into TurboTax from 2016 to 2019 and the calculations worked out well. So these are the entries I made and filed. I amended 2017 - 2019 taxes as the 2016 1099-r was correct. The annuity started 2017/01/02.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I receive a 1099R statement of Survivor Annuity paid Box 2a on my survivor annuity shows UNKNOWN AS TAXABLE AMOUNT what amount should it be

Given the exclusion rule (which I am aware of), and given that block 2a on the OMB 1099R reads "UNKNOWN", how does the TurboTax user exclude the exclusion amount from taxable income? Are you saying subtract it from the amount in block 1 and enter the reduced amount in 2a of the form provided by TurboTax even though the paper form reads "UNKNOWN"?

I have calculated and excluded it myself in the past - but only on the form 1040. I haven't used TurboTax in the past...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I receive a 1099R statement of Survivor Annuity paid Box 2a on my survivor annuity shows UNKNOWN AS TAXABLE AMOUNT what amount should it be

@macuser_22 Forget my question. I figured it out. But for anyone else confused as to how to get to the simplified method:

When Turbotax asks if the amount in block 1 of the OPM 1099R is "the taxable amount" the user has to select "No". I selected "yes" :(. Don't know for how many of you this was the problem but if you select "no" then it asks if you want to use the simplified method.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I receive a 1099R statement of Survivor Annuity paid Box 2a on my survivor annuity shows UNKNOWN AS TAXABLE AMOUNT what amount should it be

HOWEVER - despite that the 1099R reads "UNKNOWN" in block 2a, TurboTax won't allow that entry. Instead, it won't allow letters and, if you leave it blank, it computes that NONE of block 1 is taxable! I got to this point on my first pass. I'm not sure why at some point I selected that the amount in block 1 was the taxable amount but it might be because of the result of my first pass.

Turbotax wasn't helping to let me know anything here and I might have let them tax the entire block 1 amount if I wasn't already aware that it wasn't fully taxable. The software should let the user enter what the block reads and, if it reads "UNKNOWN" the software should be programmed to guide the user to compute the taxable amount. To me this an issue and a Turbotax failure. How are you "guaranteeing" the max refund when you let the user tax their entire payout here because you won't let the user enter what block 2a commonly reads?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I receive a 1099R statement of Survivor Annuity paid Box 2a on my survivor annuity shows UNKNOWN AS TAXABLE AMOUNT what amount should it be

If your 1099-R has UNKNOWN as the taxable amount, you probably have a CSA 1099-R. If you have not indicated that this is a CSA form, go back into TurboTax in the 1099-R section and enter your CSA 1099-R, making sure to indicate before you enter the form that it is a CSA 1099-R. Then leave the taxable amount box blank and TurboTax will guide you through the interview to determine the taxable amount. Make sure to delete the incorrect 1099-R.

Either way, if Box 2a reads unknown, leave it blank and TurboTax will provide you with follow-up questions. Anyhow, if you are using Turbo Tax Online, when you get to the following screen, here is where you will make the selection. Be sure to pick the image in green.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I receive a 1099R statement of Survivor Annuity paid Box 2a on my survivor annuity shows UNKNOWN AS TAXABLE AMOUNT what amount should it be

OK.

Maybe.

I wrote earlier that I'd finally figured it out. I think, on my first pass, when it wouldn't let me enter "UNKNOWN", I entered 0. I seem to recall that it wouldn't let me leave it blank but I could be wrong. When I entered 0 and TT computed that nothing was taxable I probably went back and put the full block 1 amount in 2a.

I can't overemphasize that TurboTax needs to allow the user to enter what the form reads. Expecting the user to go with blank (even if it allows that) is NOT a good solution. Block 2a is NOT blank. It should allow "UNKNOWN" and then do as you say it does if one leaves it blank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I receive a 1099R statement of Survivor Annuity paid Box 2a on my survivor annuity shows UNKNOWN AS TAXABLE AMOUNT what amount should it be

It won't allow you to record unknown in 2A because as you alluded to earlier, it expects a number and not letters. Leaving it blank initially will allow Turbo Tax to populate the number once you have recorded the CSA-1099R.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I receive a 1099R statement of Survivor Annuity paid Box 2a on my survivor annuity shows UNKNOWN AS TAXABLE AMOUNT what amount should it be

?? thought I conveyed that we're in agreement that TT software won't allow "UNKNOWN".

What I'd like to convey to TT is that this is a software error. It should allow "UNKNOWN". It should allow whatever the from reads. Seems obvious to me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I receive a 1099R statement of Survivor Annuity paid Box 2a on my survivor annuity shows UNKNOWN AS TAXABLE AMOUNT what amount should it be

Wouldn't be too hard to place an indication on the screen to solve a lot of misguidance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I receive a 1099R statement of Survivor Annuity paid Box 2a on my survivor annuity shows UNKNOWN AS TAXABLE AMOUNT what amount should it be

Yes. TurboTax needs to do something because expecting the user to just know to leave it blank borders on negligent.

I still think TT should let the user enter what OPM put on the form. I vaguely recall somebody previously writing that putting words in some of the fields on the OMB 1099 was "illegal" but:

1. I doubt any laws have been passed prohibiting it (so it's not "illegal"), and

2. even if it is "illegal", OMB put it on the form. TT would just be allowing the user to enter what OMB put on the form. I doubt even politicians would pass laws making that illegal.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

M-H-Ribner

New Member

janicezheng_hi

New Member

Ikigai

New Member

Ikigai

New Member

sewartist

New Member