- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Entered $10 from 1099-INT and it reduced my Federal return by $11 and NJ state return by $1. Total $12 reduction in return. How is it possible ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entered $10 from 1099-INT and it reduced my Federal return by $11 and NJ state return by $1. Total $12 reduction in return. How is it possible ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entered $10 from 1099-INT and it reduced my Federal return by $11 and NJ state return by $1. Total $12 reduction in return. How is it possible ?

It is possible. As you enter $10 interest income, your taxable income will increase by $10. Tax is increased by $2 to $3, and income-based credits such as the earned income credit may decrease by a larger amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entered $10 from 1099-INT and it reduced my Federal return by $11 and NJ state return by $1. Total $12 reduction in return. How is it possible ?

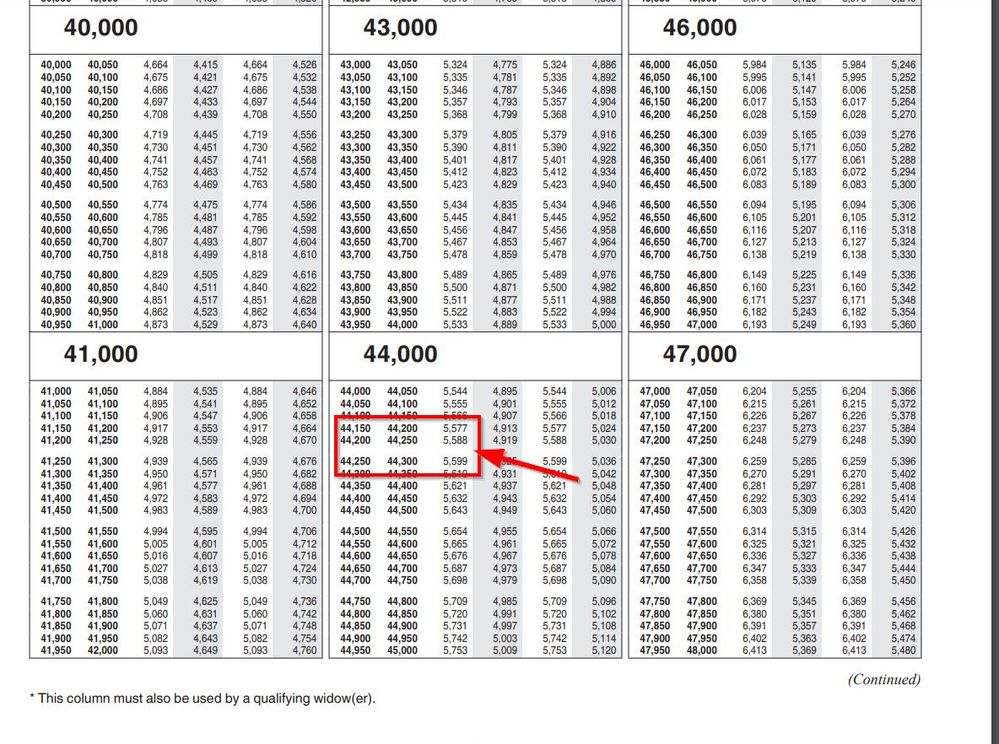

Your federal tax liability is determined from the tax tables in $50 increments of income. Adding even a single dollar of income has a chance of moving you from one $50 step to the next. When you are in the 22% tax bracket, a step to the next $50 increment means $11 of additional federal tax liability.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entered $10 from 1099-INT and it reduced my Federal return by $11 and NJ state return by $1. Total $12 reduction in return. How is it possible ?

I once added $6 in interest and the tax went up $12! It pushed me into the next tax bracket. I was right at the line. Here is part of the Tax Table. If you are Single and went from 44,240 Taxable Income and added $10 the tax jumps from 5,588 to 5,599 and increase of $11

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

holleydavis90

New Member

Blingy

New Member

sunshine00507

New Member

loy-gonzales-gma

New Member

b4se597025

New Member