- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Back door IRA help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

I double checked:

The total basis as of Dec, 31, 2019, I put down $6000, as shown on my 8606 form last year (2019).

The next screen value of traditional IRA as of Dec, 31, 2020, I put down $5.56 (because I made a conversion from traditional IRA to roth IRA with the $6000 during 2020, so there is little leftover money).

My question is: the contribution to traditional IRA is after-tax and nondeductible, why I am taxed a second time just converting it to Roth IRA?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

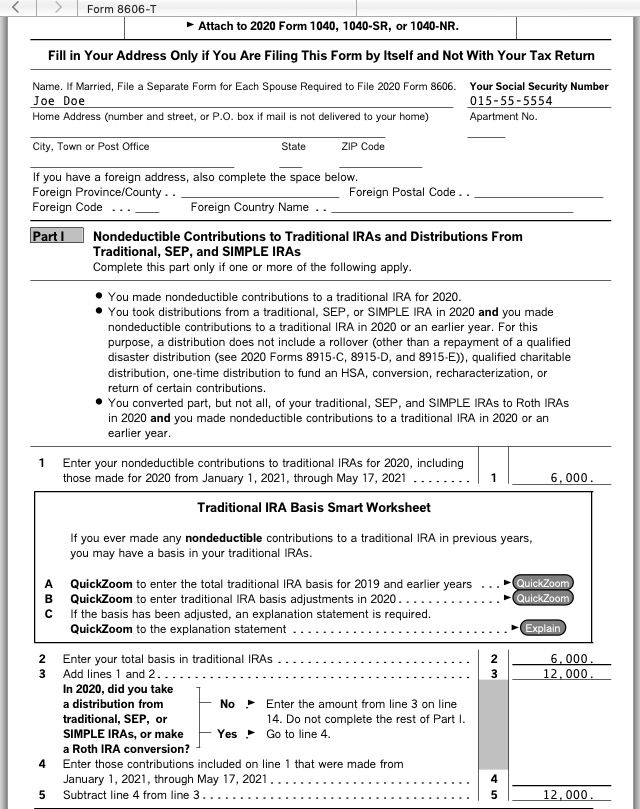

I checked my current 8606.

Line 1:$6000

Line 2: $0

Line 3: $6000

Line2 didn't change to $6000 even though I put down $6000 as IRA basis

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

I had a typo in my last post. the total of the 8606 line 2 + 3 should be $12,000 to offset the $12,000 distribution.

Line 1 comes form the 2020 non-deductible contribution and line 2 comes form the basis as of Dec 31, 2019 1099-R question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

Regards to line 2 didn't change.

Will it be affected by the fact that I have $6000 excess withdraw for 2019, but in the year of 2020?

The 8606 line 2 doesn't look right just showing $0 instead of $6000

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

Are you using the CD/download desktop version of the online version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

I am using windows CD download version.

With your help, I have checked everything (in the deductible section and 1099-R section), but the numbers just didn't change.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

@crystalPP wrote:

I am using windows CD download version.

With your help, I have checked everything (in the deductible section and 1099-R section), but the numbers just didn't change.

When entered according to my screenshot the 8606 looks like this.

On the "Lets find your IRS basis" that is has *your* name - not your spouses name.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

I did follow your steps and put $6000 for IRA basis (as of Dec, 31, 2019) for **myself**, not my spouse.

But it didn't carried over to the form 8606, line 2 is still showing 0, not $6000 as it is supposed to be.

I've talked to a turbotax agent over the phone and he walked me through all the related fields, making sure everything I did was correct. He was also puzzled why form 8606 doesn't show up correctly.

Case was still open. It should be very straightforward, as long as line 2 on 8606 is filled up with $6000 basis, I won't have any more tax obligation. I don't know whether that's an issue with desktop version turbotax. Or there is anything else may affect form 8606 line 2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

@crystalPP wrote:

I did follow your steps and put $6000 for IRA basis (as of Dec, 31, 2019) for **myself**, not my spouse.

But it didn't carried over to the form 8606, line 2 is still showing 0, not $6000 as it is supposed to be.

I've talked to a turbotax agent over the phone and he walked me through all the related fields, making sure everything I did was correct. He was also puzzled why form 8606 doesn't show up correctly.

Case was still open. It should be very straightforward, as long as line 2 on 8606 is filled up with $6000 basis, I won't have any more tax obligation. I don't know whether that's an issue with desktop version turbotax. Or there is anything else may affect form 8606 line 2.

Switch to the forms mode and view the "IRA Information Worksheet" line 12. It should have the $6,000 on it, if not, enter it there manually. (Taxpayer is the first person on the tax return, Spouse is the second listed person).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

Hi there,

I think I figured out where the problem is.

By going to the "IRA Information Worksheet", I found line 12 is $6000 and line 13 (adjustment due to return of excess amount) is $6000 too, which made line 17 adjusted total basis to 0.

In my case, since I made $12000 contribution to traditional IRA in 2019 and the withdrawal of excess amount happened in 2020, so as of Dec, 31, 2019, my IRA basis should be $12000, instead of $6000, because all the money was left in that account. If I put down my IRA basis to $12000 instead of $6000, then everything is back to normal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Back door IRA help!

Glad you found it.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

s-craig2528

New Member

MADY1977

Level 1

McReynolds1994

New Member

user17682717859

Returning Member

K_Stasey

New Member