- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: 8915-E from 2020 was the form I used to address a 401K withdrawal, I understand that form is ...

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915-E from 2020 was the form I used to address a 401K withdrawal, I understand that form is 8915-F for 2021 but how do I get this form to populate?

I did not get a 1099R for 2021, this was done in 2020

Topics:

posted

April 1, 2022

11:08 AM

last updated

April 01, 2022

11:08 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915-E from 2020 was the form I used to address a 401K withdrawal, I understand that form is 8915-F for 2021 but how do I get this form to populate?

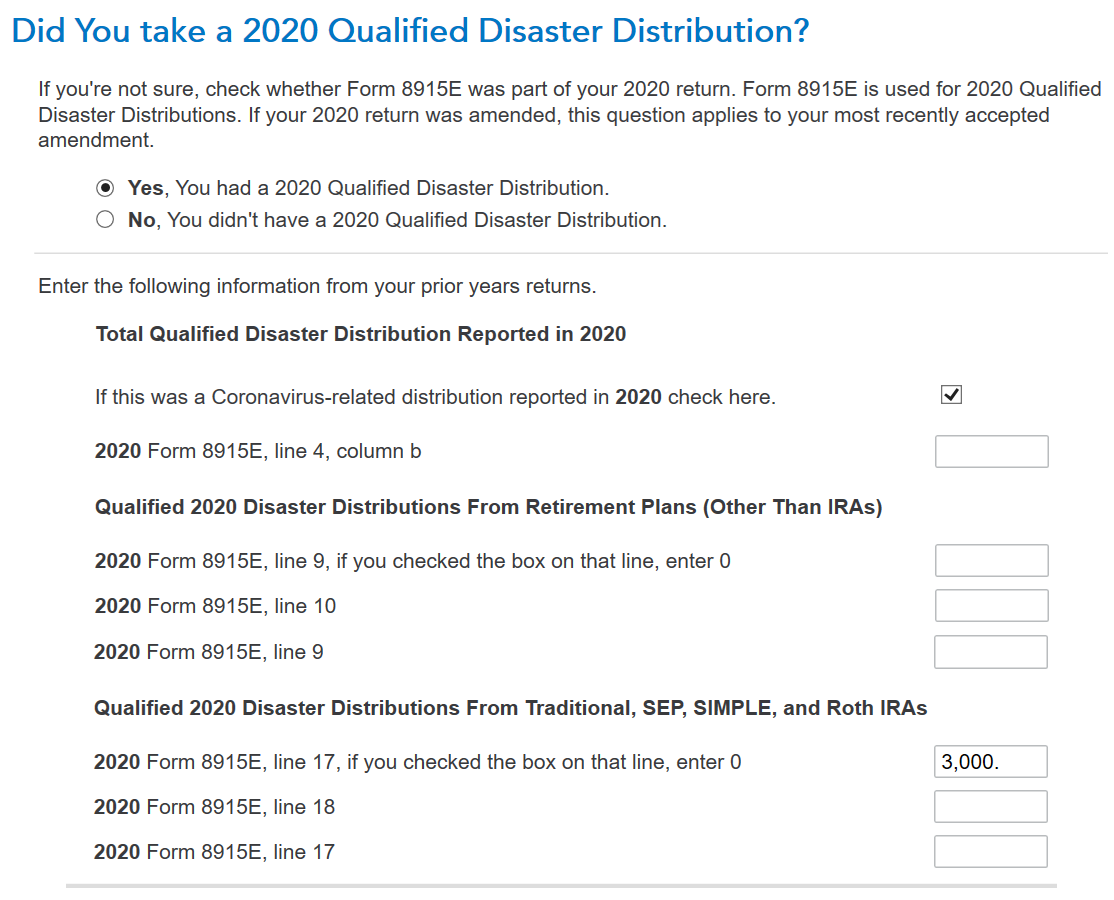

Review the steps and see the images below. The following steps should be used to enter your COVID qualifying distribution. Do Not enter a FEMA code because this doesn't have one. You must have your Form 8915-E from your 2020 tax return.

- Wages & Income > Retirement Plans and Social Security >

- IRA, 401(k), Pension Plan Withdrawals (1099-R) > Start, Revisit or Update > Continue

- Answer Yes 'Have you ever taken a disaster distribution before 2021?

- Answer Yes, You had a 2020 Qualified Disaster Distribution

- Complete the Information using your 2020 Tax return > Continue (use either section but not both (Pension or IRA depending on your situation)

- Enter any amount you may have repaid in 2021, if applicable

- Finish the entry for your spouse if applicable or just click Continue

- Complete any additional retirement questions as you move through this section

- Continue until you have finished and returned back to the Wages & Income Screen.

- Do NOT stop and change sections without completing it.

If the 2020 distribution was from an account that was Not an IRA

- 2020 Form 8915E Line 9 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

If the 2020 distribution was from an IRA account

- 2020 Form 8915E Line 17 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

Do not enter anything in the other boxes, leave them blank (empty).

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 1, 2022

11:23 AM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.