- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: 1099-R

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

Annually wife and I fund non-traditional IRAs (funded with after tax dollars) and convert them to Roth IRAs same year. Received 1099-Rs for the rollover showing full amount as taxable, although on the earnings for the year should be since the IRAs were funded with after tax dollars.

How do I show this on return noting only the earnings as taxable?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

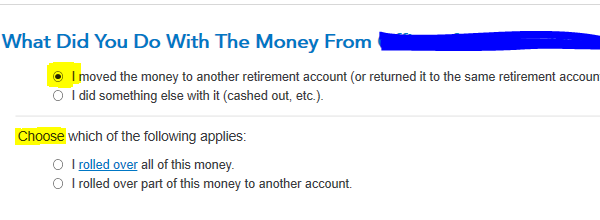

You will get the rollover questions after you enter Form 1099-R. There will be follow-up questions after you enter the form. The screen will ask what you did with the money, see below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

If the form 1099-R that you have is coded "N" in box 7 for recharacterized IRA, then the distribution will not show as taxable, so you can enter it as it is stated. Otherwise, if you enter it and the distribution is showing as taxable, you will need to get it corrected by the issuer.

You can prepare a substitute form 1099-R to report the earnings on the distribution. Enter the earnings in box 1 and box 2 and use code "8" in box 7. You will see an option to prepare a substitute form 1099-R in TurboTax as follows:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

Box 7 is marked as '2' Early Distribution even though it was rolled to Roth.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

Box 7 is marked as '2' Early Distribution even though it was rolled to Roth.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

You should enter the form 1099-R the way it is stated, but indicate that it was rolled over to another traditional IRA, that way the distribution won't show as taxable. Then, do the substitute 1099-R entry to report the taxable earnings.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

Thank you Thomas! Where do I indicate that it was a rolled over?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

You will get the rollover questions after you enter Form 1099-R. There will be follow-up questions after you enter the form. The screen will ask what you did with the money, see below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rodiy2k21

Returning Member

Tater19

Level 1

NANCYHIRD46

New Member

elle25149

Level 1

Angel_eyes_4eva

New Member