- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Question about 1099-R Distribution from a Pension

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about 1099-R Distribution from a Pension

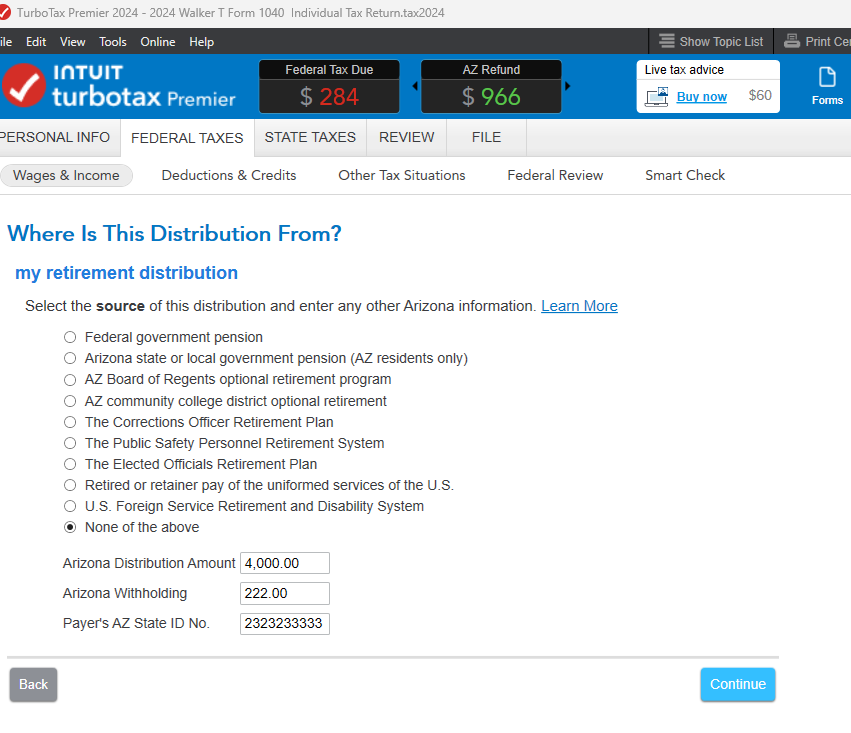

I received a 1099-R form for a monthly pension from that new jersey taxes are taken from each month. I need to pick a source of this distribution. I assumed that I should pick The general rule pension or 401-k benefits. It was not a 401 distribution, but a 403b distribution from a non profit that is sent on a regular monthly basis.

Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about 1099-R Distribution from a Pension

If your pension is from a 403b plan, on the 'Where is this distribution from?' page choose 'None of the above'. Your State Distribution amount and tax paid will be displayed in the boxes below this.

On the next page, 'Was this Distribution from a Qualified Plan?' select Qualified Plan. On the next page, select 'Yes, this is from a 403b.'

You may be asked about RMD. If you know your RMD amount, you can enter it, or you can enter an amount equal to or less than your distribution (or $0).

Continue through the rest of the screens to the end of the section and you should be all set. If you get an error, you can delete your 1099-R entry and re-enter it. If you're using TurboTax Online, clear your Cache and Cookies first.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about 1099-R Distribution from a Pension

Thank you! I believe this is the best resolution!😊

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kejjp00

New Member

Smithy4

New Member

rbucking4

New Member

judith-legare

New Member

keeponjeepin

Level 2