- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- PBGC 1099-R

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PBGC 1099-R

I receive monthly pension payment from State Street Retiree Services for USPBGC from an airline bankruptcy. My form 1099-R has box 2a blank and 2b checked(taxable amount not determined). Box 4 shows the Federal Income tax withheld that PBGC deducts every month as my election. When I go through the TurboTax steps it treats it as an Annuity and wants me to use the simplified method. I am lost at this point so I just input the date that my PBGC payments started and every 12 months and leave the rest blank. How should I correctly go through this step. Thanks Mark

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PBGC 1099-R

You are doing okay. If Box 2a is blank on your 1099-R form, the taxable portion of your distribution needs to be calculated: Is my distribution nontaxable if Box 2a on my 1099... (intuit.com).

Because you are getting regular monthly payments it is considered a Pension. The annuity question suggests that you put money into the plan. I don't think you did. Therefore, there would not be any "basis" that would be calculated as non taxable.

Finally, the tax withholding that you have in Box 4 will be credited to you on your tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PBGC 1099-R

You are doing okay. If Box 2a is blank on your 1099-R form, the taxable portion of your distribution needs to be calculated: Is my distribution nontaxable if Box 2a on my 1099... (intuit.com).

Because you are getting regular monthly payments it is considered a Pension. The annuity question suggests that you put money into the plan. I don't think you did. Therefore, there would not be any "basis" that would be calculated as non taxable.

Finally, the tax withholding that you have in Box 4 will be credited to you on your tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PBGC 1099-R

Best answer I have received or found, thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PBGC 1099-R

I am having the very same problem. TT keeps on asking me for the cost of the annuity and the age at which I started taking the annuity. Help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PBGC 1099-R

While you were working, did you ever put after-tax money into the retirement plan (most people don't)?

If you did not, then do the following:

- When you are asked, say that it is a qualified plan.

- Then on the next screen, say that "you did something else with the money"

- Then on the next screen, say that you got regular payments

- Then on the next screen, say that you started getting payments prior to 2021 (unless you started in 2021, in which case to check 2021).

- Then on the next screen, check YES the amount in Box 2a was used (Yes, I know that box 2a is empty).

- This will cause Box 2a (taxable amount ) to be set to Box 1 (gross distribution), which is correct if you have no after-tax contributions in the plan (i.e., "basis").

- Then answer one or more disaster questions with NO, I DIDN'T (unless you did).

This process avoids the Simplified method and the answers you don't know like the start date and your starting age.

@00-7

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PBGC 1099-R

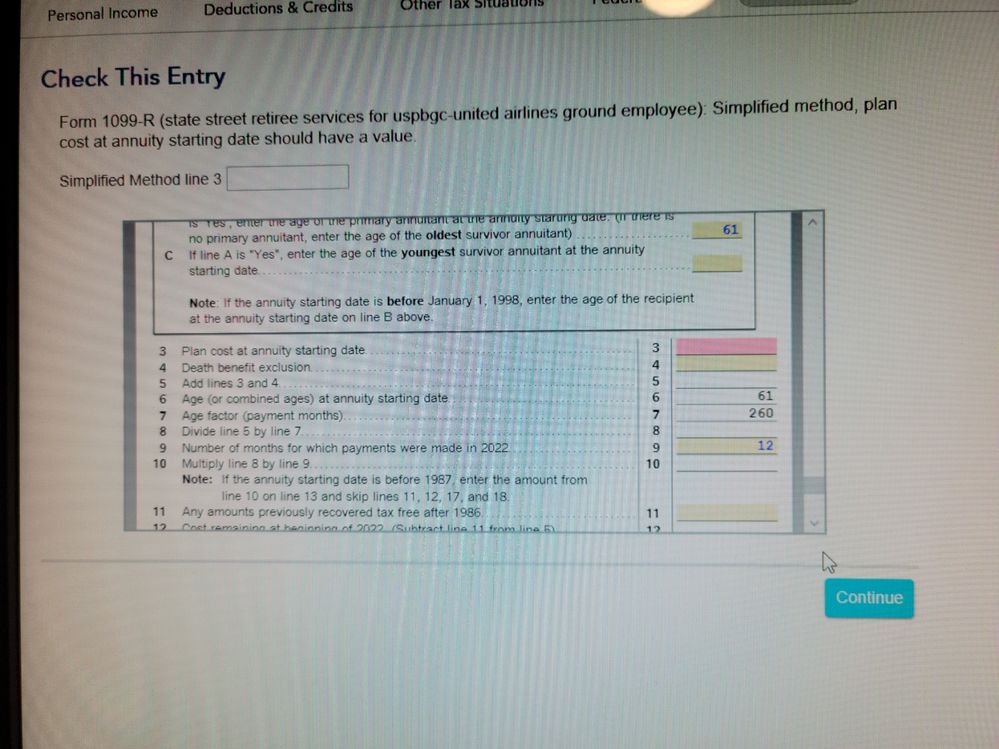

I followed the steps 1-7 to enter the info from my pbgc 1099R and when TT checks for errors it says I am missing the plan cost at annuity starting date. This 1099 is from when the pbgc took over the UAL pensions when UAL filed bankruptcy. I even added the from box 1to the blank box 2A (taxable amount).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PBGC 1099-R

The plan cost at annuity start date refers to your total after-tax contributions in the plan.

If you did not make any after-tax contribution to the retirement plan, then you would enter “0” for the plan cost at annuity start date.

If this is the first year you are receiving distributions from the retirement plan and you did make after-tax contributions, the plan cost (your after-tax contributions) may be listed in box 9b of your Form 1099-R. If the information is not listed there and you are not sure whether you made any after-tax contributions to the plan, you should contact your plan administrator.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PBGC 1099-R

Thank you!!!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ann12p

New Member

ken-golkin

New Member

tresus95

New Member

hedgie

Returning Member

Binthuy73

New Member