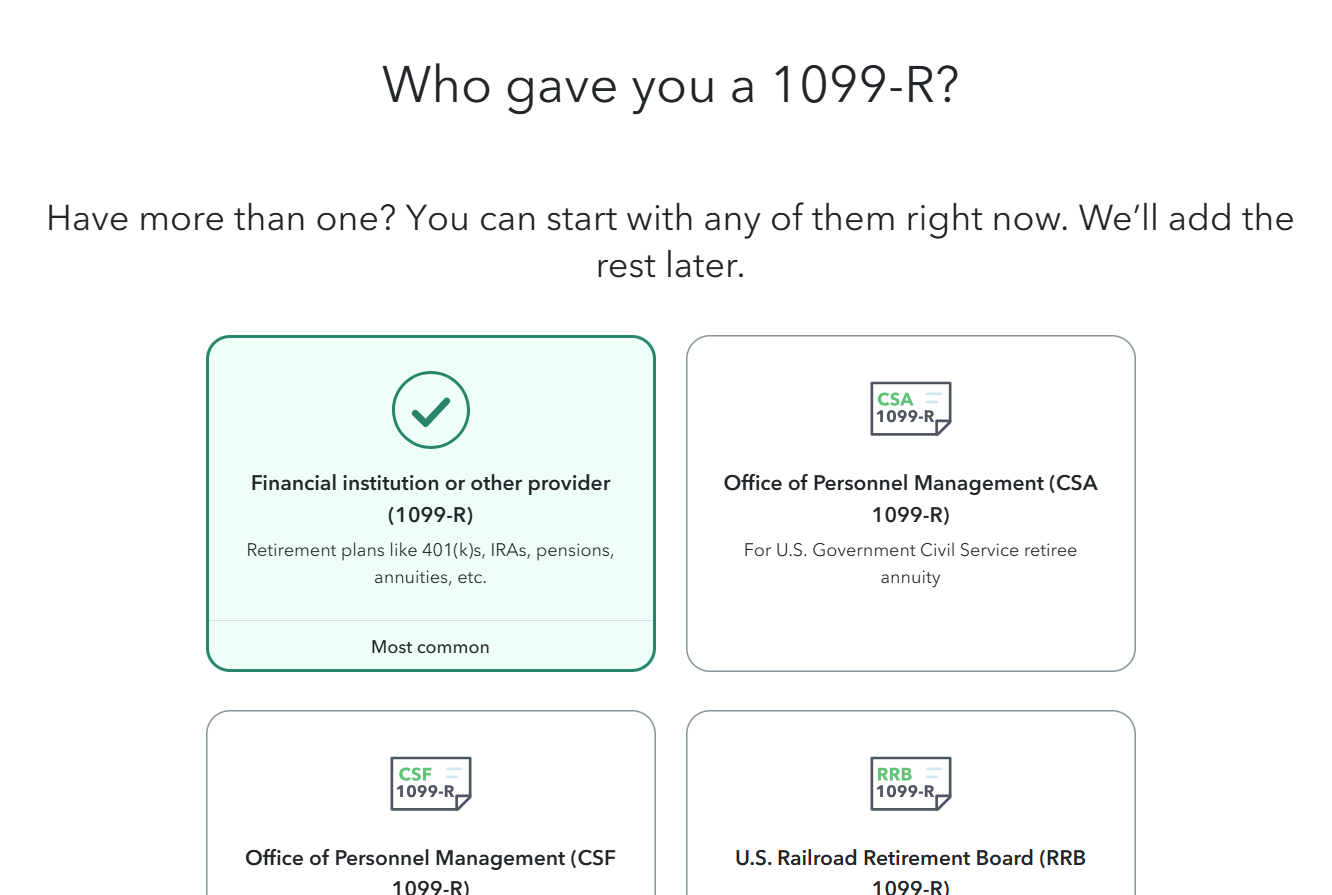

Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R. After you enter the 1099R in the screen, TurboTax will ask additional questions about your 1099R to determine how much of that distribution is taxable.

If box 2a says UNKNOWN leave it blank in TurboTax. Don't enter anything. Later on, when it asks you if the amount in box 2a was used as the taxable amount in past years, answer Yes, even though box 2a is blank. It will use the amount in box 1 as the taxable amount.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"