- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Keogh, SEP, and SIMPLE Contribution Sheet not working correctly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Keogh, SEP, and SIMPLE Contribution Sheet not working correctly

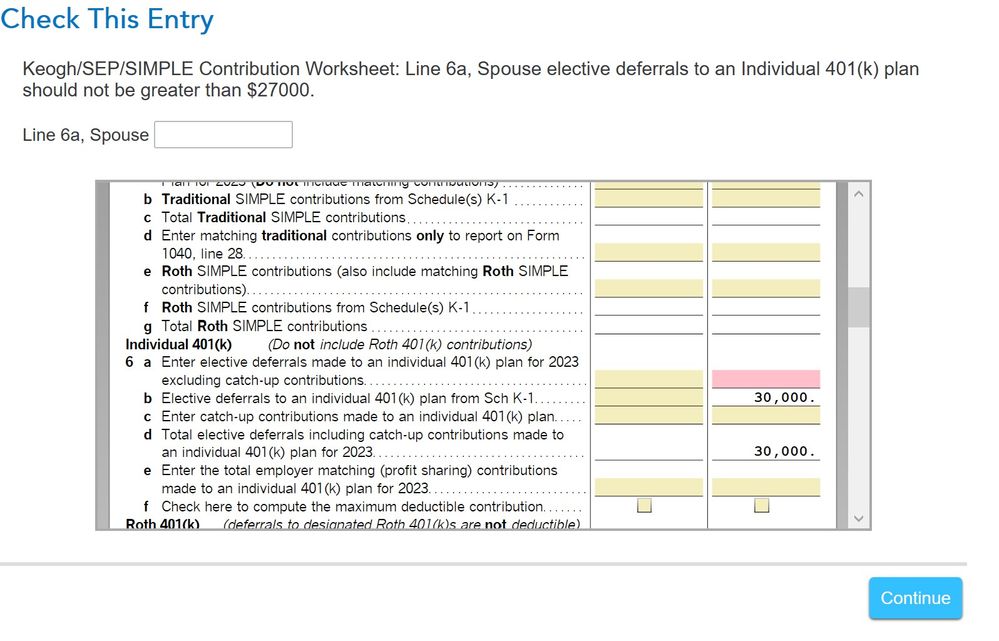

I am getting an error on this worksheet that prevents me from e-filing. I do not have an amount on line 6a because my spouse's 401K election and catch-up contributions are reported on a K1. Even if I enter $0 here I get the same error, which makes no sense. Also, the $27,000 limit is the limit for the total of the elective deferral including catch-up contributions for 2022. That limit should be $30,000 for 2023. The only way I have found to get around this so I can file is to enter $-3,000 on line 6a which is obviously wrong. Is there a way to get around this error so I can E-file

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Keogh, SEP, and SIMPLE Contribution Sheet not working correctly

You are correct that, for a retirement contribution reported with code R in box 13 of a Schedule K-1 (Form 1065), 2023 TurboTax is still imposing the 2022 elective deferral limit of $27,000 instead of the 2023 limit of $30,000 for those over age 50. Perhaps @BillM223 can report this. I've sent Token 1213105 showing a simple example.

In my token example, changing the box 13 code R entry and the code R additional information entry to $27,000 eliminates the error. The error reappears if the amount is changed to $27,001.

This error is present for both Taxpayer and Spouse although my token example shows only the Spouse entry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Keogh, SEP, and SIMPLE Contribution Sheet not working correctly

Thank you. I have been on the phone with Turbotax support most of the morning and to their credit they recognize there is a problem and are working to come up with a work around. In the meantime it looks like I can enter $0 in Box R on the K1 and Report $22,500 on line 6a and $7500 on line 6c of the worksheet. I still get total contributions of $30,000 but no longer get the error message. This appears to generate a form 1040 that is identical to reporting everything through the K1. I would much prefer that the program error get fixed though.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Keogh, SEP, and SIMPLE Contribution Sheet not working correctly

Yes, reporting on lines 6a and 6c should be a suitable workaround.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Keogh, SEP, and SIMPLE Contribution Sheet not working correctly

I'm having the exact same problem. Was just going to print my tax return and mail it in, since I dont' know how long it will take Turbotax to fix this problem. The agent on the line was clueless and instructed me to delete my K1 statement and re enter it which also deleted depreciation info carried forward from previous years and took a whole morning to re-figure out and re-enter and did not solve the problem.

Feeling really upset that they can't update the contribution data properly

If you enter the data in the other lines in the worksheet and remove the $30,000 from the K1 statement, will that create any issues? I'm just worried that the K1 data the IRS gets and the data from turbotax filing will conflict and raise a red flag for tax audit. Not enough of a tax expert to know what exactly the IRS sees...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Keogh, SEP, and SIMPLE Contribution Sheet not working correctly

The IRS will be unaware that you used this workaround. The filed tax return will be identical to what it would have been had the workaround not been necessary.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Keogh, SEP, and SIMPLE Contribution Sheet not working correctly

I would have to change the K1 line 13R total to make it work. The IRS does not get the K1 data that I input into Turbotax? I just don't want to have this be an audit flag because of data discrepancy in the K1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Keogh, SEP, and SIMPLE Contribution Sheet not working correctly

"The IRS does not get the K1 data that I input into Turbotax?"

Correct. This detail is not included in your filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Keogh, SEP, and SIMPLE Contribution Sheet not working correctly

So I would have to return to K1 questions and enter $0 in box R on K1. But how do I return to the worksheet and manually enter the line 6a and 6c?

How to find that Keogh/SEP/Simple contribution worksheet? I am using Turbotax online so I don’t know how to jump into that worksheet and manually enter the 6a and 6c lines.

Please help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Keogh, SEP, and SIMPLE Contribution Sheet not working correctly

The worksheet can be accessed in forms mode of the CD/download version of TurboTax. Otherwise, the section for self-employed retirement contributions can be accessed under Wages & Income -> Other Business Situations -> Self-Employed Retirement Plans

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Keogh, SEP, and SIMPLE Contribution Sheet not working correctly

Turbotax has a program update that appears to resolve this error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Keogh, SEP, and SIMPLE Contribution Sheet not working correctly

Yes I login last night, and they fixed the bugs. It work fine now

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Keogh, SEP, and SIMPLE Contribution Sheet not working correctly

I've updated to the latest version of Turbotax and am experiencing the same issue. When I go to file, it's prompting me to fill in the line for 6a, for elective taxpayer deferrals. In my case, there was no taxpayer deferrals and the payments were 401k profit sharing contributions. It appears that this patch didn't fix the issue. Anyone figure how to get around this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Keogh, SEP, and SIMPLE Contribution Sheet not working correctly

I am using TurboTax ONLINE, not CD or download app; and apparently they did fix the bugs for the online version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Keogh, SEP, and SIMPLE Contribution Sheet not working correctly

Thanks for your reply. Is there a way to know whether Intuit Turbotax will fix this in a new update? It's getting really close to the filing due date, and I already paid to electronically file the state return. I'm kind of stuck right now as this is the only thing that's holding me up. Anyone with any good recommendations at this point?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ayubruin7777

Level 1

Jam89

Returning Member

bethfly

New Member

5351ea506cfa

New Member

gdweaver65

New Member