- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Keogh, SEP, and SIMPLE Contribution Sheet not working correctly

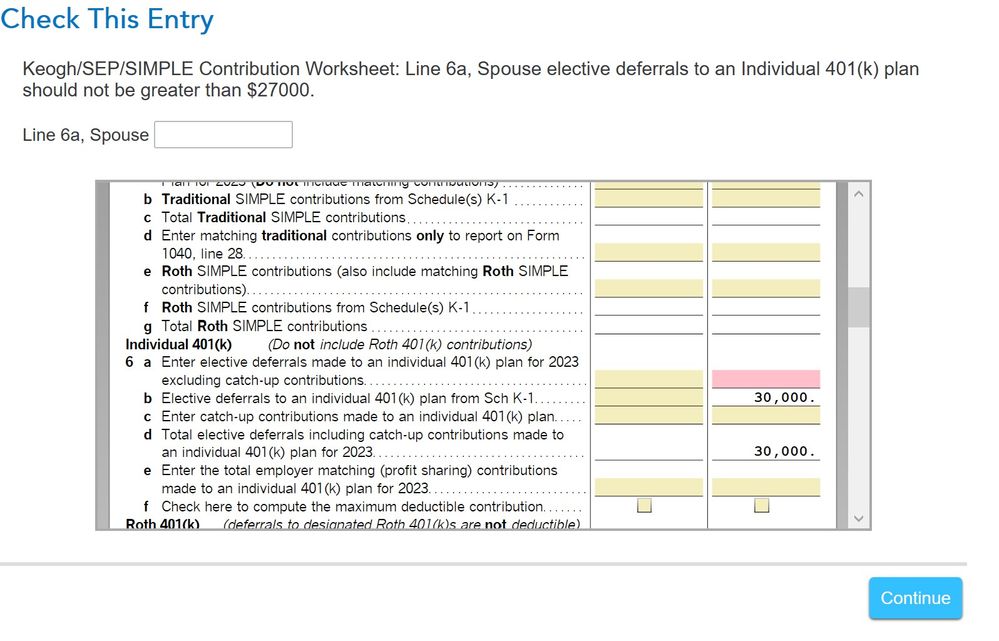

I am getting an error on this worksheet that prevents me from e-filing. I do not have an amount on line 6a because my spouse's 401K election and catch-up contributions are reported on a K1. Even if I enter $0 here I get the same error, which makes no sense. Also, the $27,000 limit is the limit for the total of the elective deferral including catch-up contributions for 2022. That limit should be $30,000 for 2023. The only way I have found to get around this so I can file is to enter $-3,000 on line 6a which is obviously wrong. Is there a way to get around this error so I can E-file

March 19, 2024

6:05 AM