It depends, do you have any unearned income? Unearned income would include a 1099-R which is a pension or retirement account like an IRA, Roth IRA, or 401(k). Other unearned income would include dividends, interest or stock sales.

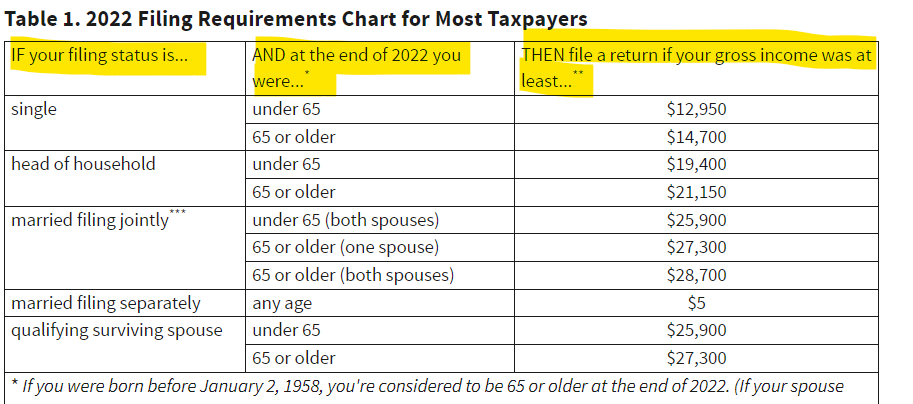

The filing requirement from the IRS show Who Must File. If you have little or no income, the section will help you decide if you need to file. If your income is more than the amount in the third column then you would need to file. If it is less than that amount, you do not need to file a tax return.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"