- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- HSA distribution (of excessive contribution) not accounted in California state taxing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA distribution (of excessive contribution) not accounted in California state taxing?

Say I initially contributed 6k into HSA in early 2024 and distributed 4K as excessive contribution in late 2024.

In Fed tax filing, the actual HSA contribution in 2024 is 2K.

However, CA state filing still adds 6K to state income, as "the contribution made to HSA by your employee".

Should I override the override that amount to 2K?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA distribution (of excessive contribution) not accounted in California state taxing?

Yes, you will want to enter the correct amount for the California adjustment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA distribution (of excessive contribution) not accounted in California state taxing?

Does anyone encounter the similar issue?

Not sure if that is an issue in TurboTax or due to the way I used TurboTax.

I assume distributions of excess HSA contribution are common, noticing that Medicare automatically moves enrollment date early, which some of the HSA contribution to be excessive, so TurboTax should handle it correctly?

The Fed tax reduced the HSA contribution after entering 1099-SA for the distribution of the excessive contribution (code 2), only CA state still assumed the original HSA contribution amount.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA distribution (of excessive contribution) not accounted in California state taxing?

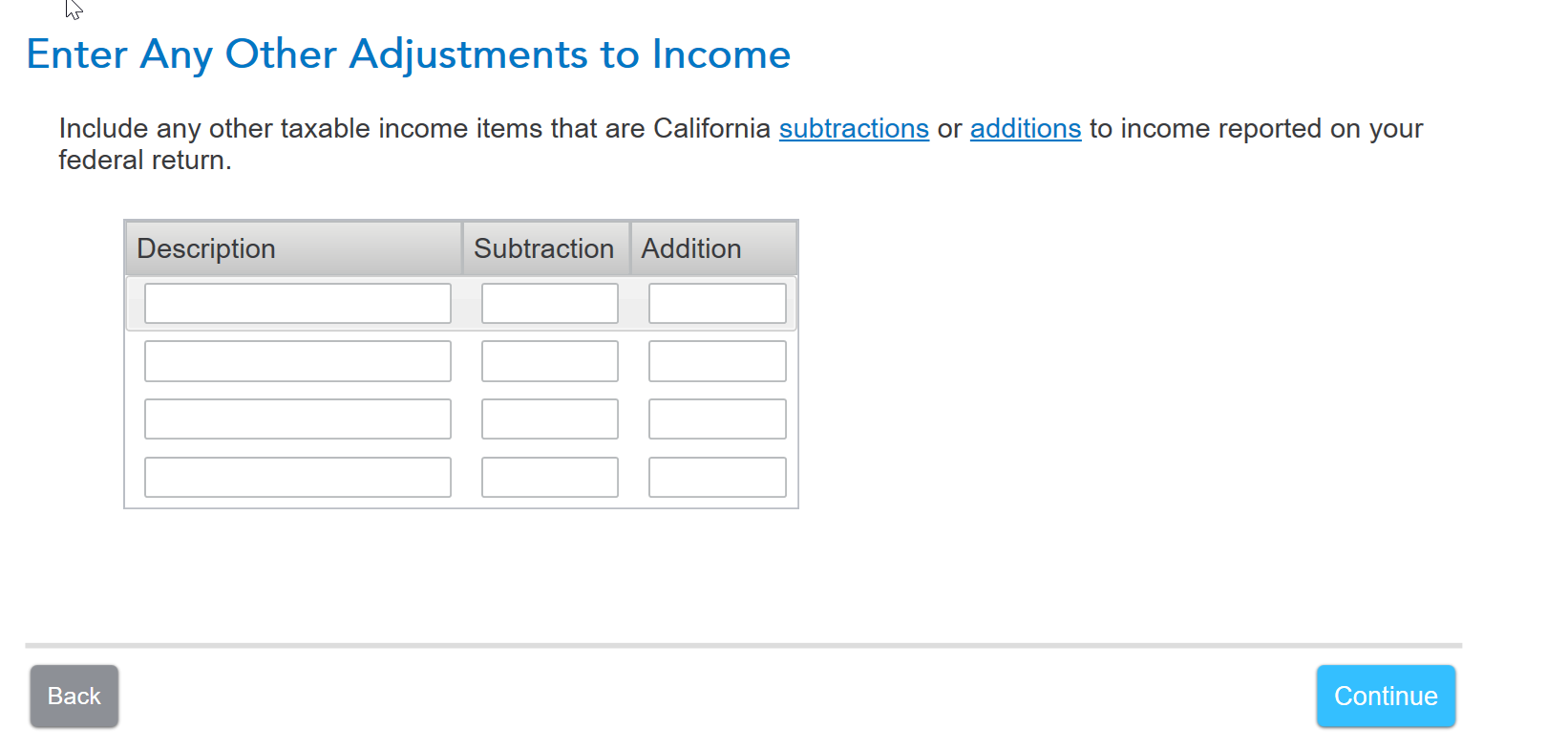

Unfortunately. TurboTax is not programmed to make the requested adjustment. You will have to make the adjustment in the Other Adjustments to Income on the "Here's the income that California handles differently" page. You can add as a subtraction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17676283632

New Member

user17670721801

Returning Member

taxman_us

Level 3

g-wright

New Member

529Tax

New Member