- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- How do I report a Traditional IRA conversion to a Roth IRA?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report a Traditional IRA conversion to a Roth IRA?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report a Traditional IRA conversion to a Roth IRA?

Indicate that you did a combination of rolling over, converting and cashing out, then enter in the conversion box the amount converted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report a Traditional IRA conversion to a Roth IRA?

So the option to code it as a Traditional IRA transfer into a Roth IRA is gone?

Why was this option removed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report a Traditional IRA conversion to a Roth IRA?

@R-CBriarwood wrote:

So the option to code it as a Traditional IRA transfer into a Roth IRA is gone?

Why was this option removed?

There is no such code and never has been. A Traditional IRA to Roth is the same as any other IRA distribution, you must report that it was a taxable distribution if converted to a Roth on the 1040 form line 4 and 8606 form that TurboTax will add for you when you enter the Roth conversion in the interview.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report a Traditional IRA conversion to a Roth IRA?

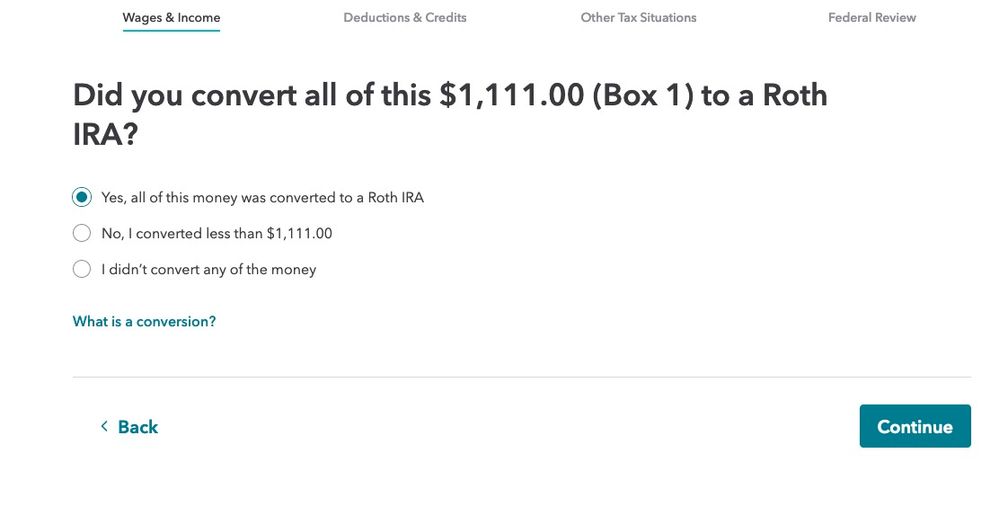

R-CBriarwood is apparently referring to the "converted all" selection that has been removed from TurboTax list of choices for describing the nature of the movement of funds from one retirement account to another. As mentioned above, indicate that you did a combination of rolling over, converting and cashing out, then enter in the conversion-amount box the amount that was converted.

Nobody here knows why the "converted all" selection was removed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report a Traditional IRA conversion to a Roth IRA?

@dmertz wrote:

R-CBriarwood is apparently referring to the "converted all" selection that has been removed from TurboTax list of choices for describing the nature of the movement of funds from one retirement account to another. As mentioned above, indicate that you did a combination of rolling over, converting and cashing out, then enter in the conversion-amount box the amount that was converted.

Nobody here knows why the "converted all" selection was removed.

That appears to be desktop only. Converted all is still an option in the online version and the poster indicated that they were using the online version.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tianwaifeixian

Level 4

tianwaifeixian

Level 4

tcondon21

Returning Member

Divideby7

Level 1

kgsundar

Level 2