- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Hello I have ebay sales via a 1099-K form. However I keep getting errors about my form "not matching" and I'm unsure what is wrong.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello I have ebay sales via a 1099-K form. However I keep getting errors about my form "not matching" and I'm unsure what is wrong.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello I have ebay sales via a 1099-K form. However I keep getting errors about my form "not matching" and I'm unsure what is wrong.

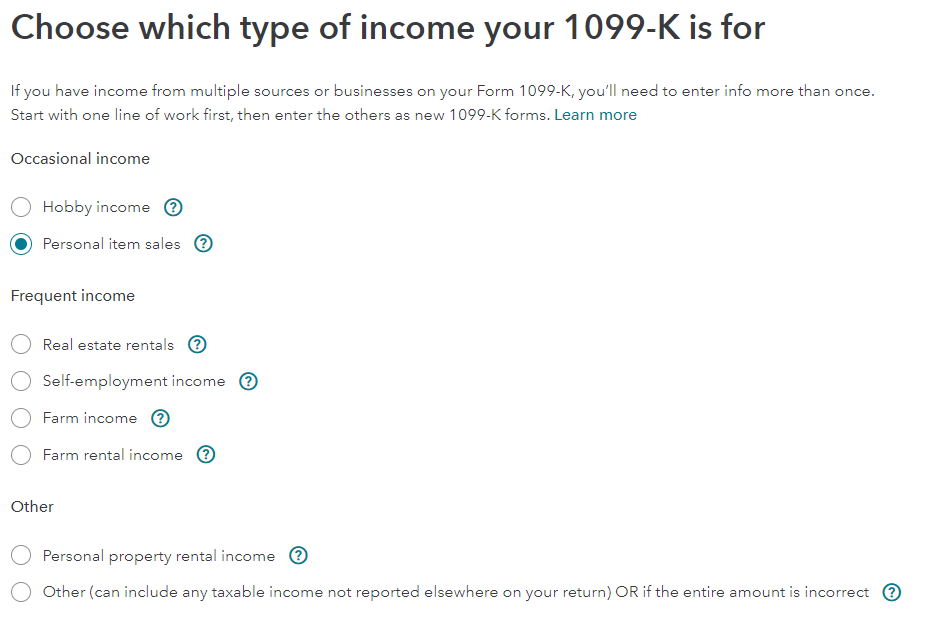

Did you post 1099-K income as Personal item sales? You would have elected this option.

You may have added an entry to your IRS form 8949 / Schedule D to put it out of balance. Review the entries listed on IRS form 8949 / Schedule D to make sure that the income reported does not exceed the income reported on the IRS form 1099-K.

I entered an IRS form 1099-K and reported it as a personal item sale. Then I entered the IRS form 8949 / Schedule D Capital Gain and Loss entry. The 1099-K income equaled the IRS form 8949 / Schedule D and the entry was in balance.

Then I clicked Add another sale and entered another personal item sale for $1 income and $1 expense. I ran Review and received a message similar to what you received.

So the 1099-K / IRS form 8949 / Schedule D became out of balance by the $1.

I deleted the $1 entry that I added by clicking the delete trashcan to the right of the entry at the screen Review your xxx sales.

You are able to view the IRS form 8949 / Schedule D Capital Gains and Losses by viewing your tax returns.

In the online versions, you may view or print at Tax Tools / Print Center / Print, save or preview this year's return / Include government and TurboTax worksheets after you have paid for the software.

To report Personal item sales, follow these directions.

- Down the left side of the screen, click Federal.

- Down the left side of the screen, click Wages & Income.

- Click Show more to the right of Other Common Income.

- Under Your income and expenses, click the Edit/Add button to the right of Form 1099-K.

- At the screen Did you get a 1099-K? click Yes.

- At the screen How would you like to enter your 1099-K? click Type it in myself. Click Continue.

- At the screen Choose which type of income your 1099-K is for, select the button for Personal item sales. Click Continue.

- At the screen Let’s get the info from your 1099-K, enter the information. Click Continue.

- At the screen Personal Item Sales, you are told that further information will need to be entered. Learn More provides detailed information for the next steps. Click Continue.

- At the screen Your 1099-K summary, notice that the income relates to ‘Sale of Personal Items’. Click Done.

- Under Your income and expenses, click the Edit/Add button to the right of Investments and Savings (1099-B, 1099-K….)

- At this screen, you will be asked to Review the Personal item sales (1099-K).

At the screen Now, enter one sale…., answer questions about the personal item sale. Click Continue.

The entry will be reported:

- on Schedule D of the Federal 1040 tax return, and

- on line 7 of the Federal 1040 tax return.

Capital loss for a personal item sale reports $0 capital gain on line 7 of the Federal 1040 tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.