- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

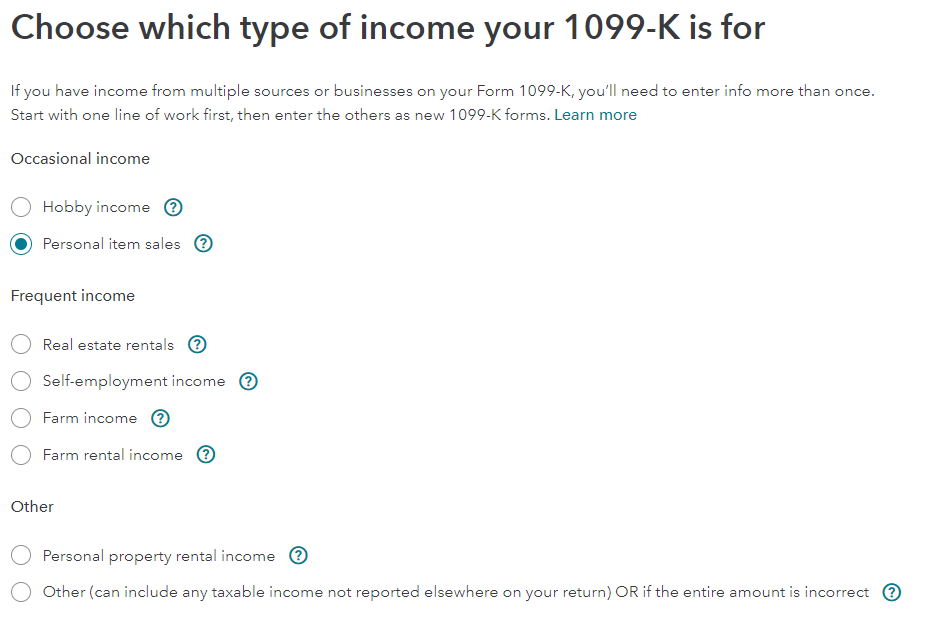

Did you post 1099-K income as Personal item sales? You would have elected this option.

You may have added an entry to your IRS form 8949 / Schedule D to put it out of balance. Review the entries listed on IRS form 8949 / Schedule D to make sure that the income reported does not exceed the income reported on the IRS form 1099-K.

I entered an IRS form 1099-K and reported it as a personal item sale. Then I entered the IRS form 8949 / Schedule D Capital Gain and Loss entry. The 1099-K income equaled the IRS form 8949 / Schedule D and the entry was in balance.

Then I clicked Add another sale and entered another personal item sale for $1 income and $1 expense. I ran Review and received a message similar to what you received.

So the 1099-K / IRS form 8949 / Schedule D became out of balance by the $1.

I deleted the $1 entry that I added by clicking the delete trashcan to the right of the entry at the screen Review your xxx sales.

You are able to view the IRS form 8949 / Schedule D Capital Gains and Losses by viewing your tax returns.

In the online versions, you may view or print at Tax Tools / Print Center / Print, save or preview this year's return / Include government and TurboTax worksheets after you have paid for the software.

To report Personal item sales, follow these directions.

- Down the left side of the screen, click Federal.

- Down the left side of the screen, click Wages & Income.

- Click Show more to the right of Other Common Income.

- Under Your income and expenses, click the Edit/Add button to the right of Form 1099-K.

- At the screen Did you get a 1099-K? click Yes.

- At the screen How would you like to enter your 1099-K? click Type it in myself. Click Continue.

- At the screen Choose which type of income your 1099-K is for, select the button for Personal item sales. Click Continue.

- At the screen Let’s get the info from your 1099-K, enter the information. Click Continue.

- At the screen Personal Item Sales, you are told that further information will need to be entered. Learn More provides detailed information for the next steps. Click Continue.

- At the screen Your 1099-K summary, notice that the income relates to ‘Sale of Personal Items’. Click Done.

- Under Your income and expenses, click the Edit/Add button to the right of Investments and Savings (1099-B, 1099-K….)

- At this screen, you will be asked to Review the Personal item sales (1099-K).

At the screen Now, enter one sale…., answer questions about the personal item sale. Click Continue.

The entry will be reported:

- on Schedule D of the Federal 1040 tax return, and

- on line 7 of the Federal 1040 tax return.

Capital loss for a personal item sale reports $0 capital gain on line 7 of the Federal 1040 tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"