- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Followed instruction on how to enter backdoor roth IR A contribution but it didn't work. It still shows entire amount from 1099-R as taxable, not just earning.

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Followed instruction on how to enter backdoor roth IR A contribution but it didn't work. It still shows entire amount from 1099-R as taxable, not just earning.

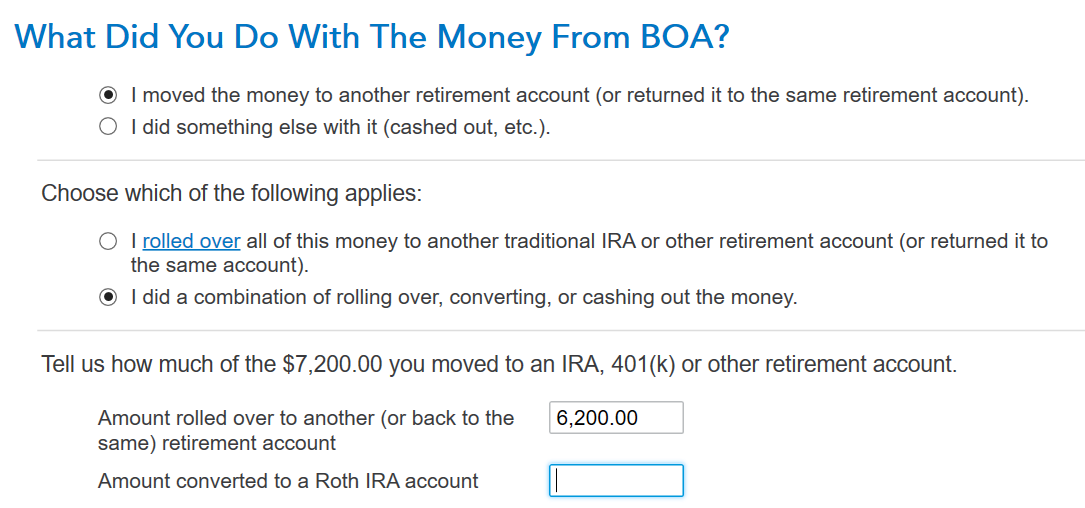

I contributed $6,000 to Traditional IRA and recharacterized $7200 (including earning) to Roth IRA. The 1099-R shows $7200 distriubution from Traditional IRA. In Turbox tax I also checked that all the amount was recharacterized as Roth IRA. I also entered the contribution of $6000 to traditional IRA. However Turbo tax shows entire $7200 taxable even though the $6,000 contribution was not tax deductible. I've followed the instuction posted in this community how to enter backdoor Roth IRA contribution.

Topics:

posted

March 17, 2022

9:27 PM

last updated

March 17, 2022

9:27 PM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Followed instruction on how to enter backdoor roth IR A contribution but it didn't work. It still shows entire amount from 1099-R as taxable, not just earning.

When your report the 1099-R form showing the $7,200 distribution, you need to indicate that $6,200 of it was rolled over to another retirement account. That should result in it not being shown as taxable on your tax return.

You can't say it is a conversion, since the contributions weren't deducted.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 18, 2022

6:26 AM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tianwaifeixian

Level 4

tianwaifeixian

Level 4

tianwaifeixian

Level 4

tcondon21

Returning Member

VAer

Level 4