- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Does Roth 401k rollover to Roth IRA impact the total basis in traditional IRAs (Line 2 of Form 8606)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Roth 401k rollover to Roth IRA impact the total basis in traditional IRAs (Line 2 of Form 8606)?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Roth 401k rollover to Roth IRA impact the total basis in traditional IRAs (Line 2 of Form 8606)?

No, it doesn't impact your Form 8606 line 2 entry. The amount rolled over will affect your Roth basis on line 22: "Increase the amount on line 22 by any amount rolled in from a designated Roth, Roth SEP, or Roth SIMPLE account that is treated as investment in the contract."

What is the code in box 7 on your Form 1099-R reporting the rollover?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Roth 401k rollover to Roth IRA impact the total basis in traditional IRAs (Line 2 of Form 8606)?

Thanks! So I still need to find out why the amount I rolled over from my Roth 401K into Roth IRA is being counted on Line 2 of Form 8606.

On my 1099-R, the distribution code is "H" -> Direct rollover of a designated Roth account distribution to

a Roth IRA.

I deleted and re-inserted this 1099-R but the amount still goes to Line 2 of Form 8606. Any idea how I can fix this?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Roth 401k rollover to Roth IRA impact the total basis in traditional IRAs (Line 2 of Form 8606)?

It would be helpful to have a TurboTax ".tax2024" file that is experiencing this issue. You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions for TurboTax Online:

- From the left menu select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen and then you will get a Token number.

- Reply to this thread with your Token number and add @DanaB27 . This will allow us to open a copy of your return without seeing any personal information.

The instructions for TurboTax Download:

- On your menu bar at the very top, click "Online"

- Select "Send Tax File to Agent"

- Click "Send"

- The pop-up will have a token number

- Reply to this thread with your Token number and add @DanaB27 . This will allow us to open a copy of your return without seeing any personal information.

We will then be able to see exactly what you are seeing and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Roth 401k rollover to Roth IRA impact the total basis in traditional IRAs (Line 2 of Form 8606)?

Thank you!

@DanaB27 here's the token number 1298577, can you help me figure out where I need to fix it?

Thanks,

Alex

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Roth 401k rollover to Roth IRA impact the total basis in traditional IRAs (Line 2 of Form 8606)?

I reviewed your return. You need to delete an entry in the IRA Easy Guide.

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- On the "Let's Find your IRA basis" screen select "Easy Guide"

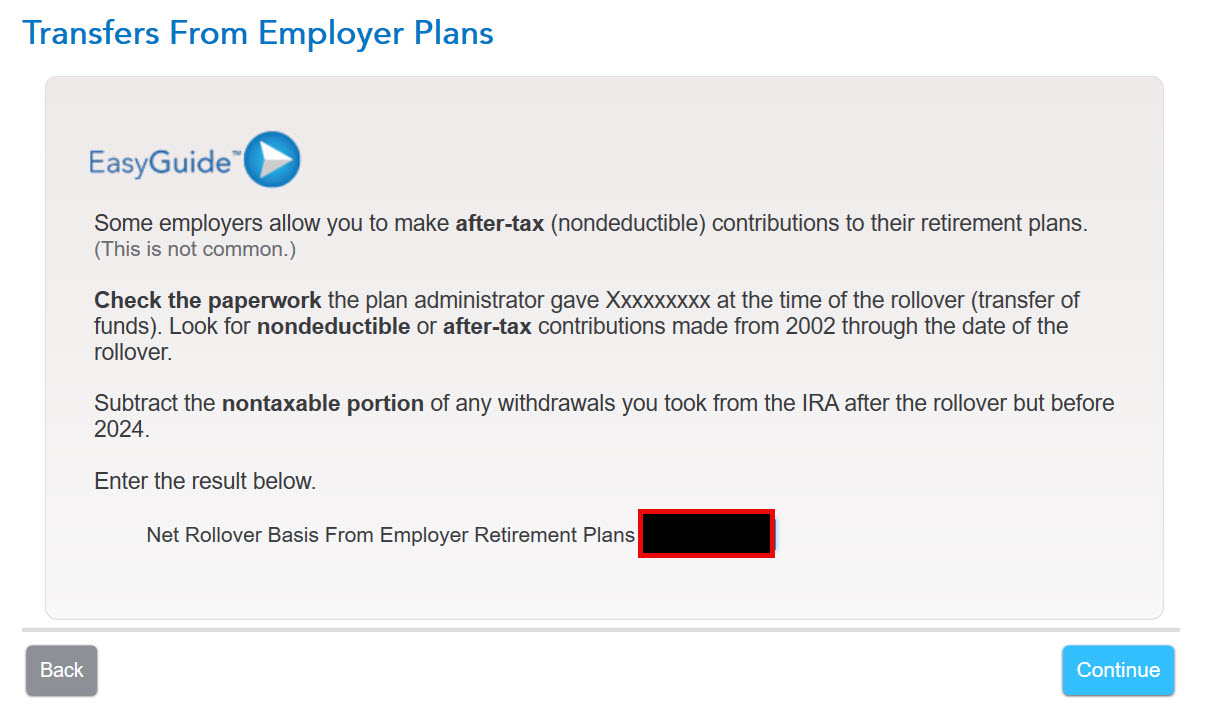

- On the "Transfer from Employer Plans" screen delete the entry

- Continue through the questions.

Note, you only enter after-tax amounts that were rolled over into the Traditional IRA on the "Transfer from Employer Plans" screen. Please see line 2 instructions for additional information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Roth 401k rollover to Roth IRA impact the total basis in traditional IRAs (Line 2 of Form 8606)?

To: DanaB27 , thank you!

Couple of follow up questions:

1. Can you double check if this is making sense now? Code is 1300253.

2. How can I manually add IRS Form 5329 online without a 1099-R and be able to file it electronically with the rest of my return? This is for missed RMD withdrawals.

Thanks,

Alex

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Roth 401k rollover to Roth IRA impact the total basis in traditional IRAs (Line 2 of Form 8606)?

1. Yes, the Forms 8606 look correct.

2. If you do not have a Form 1099-R to file for a RMD and are under 73 then this can only be done using the "forms" mode which is only available with the TurboTax Desktop software:

- Enter the forms mode and click on "Open Form" and type "5329".

- Scroll down to Part IX line 52a and enter the RMD amount that should have been taken. On line 53a enter the amount of the RMD that was actually taken (probably zero if it was missed).

- Then in the box right under line 53 "Waiver of Tax Smart Worksheet" enter the same amount as line 52 (the RMD amount) under A.

- Click the "Explanation" button and enter the reason for missing the RMD and your statement requesting a waiver.

If using the TurboTax Online version you will have to prepare the 5329 manually.

Download Form 5329 from the IRS website and fill it out the same as above. Print and mail your return with the 5329 form and explanation attached as described in the 5329 instructions.

The 2024 Form 5329 must be attached to your printed and mailed 2024 tax return and cannot be e-filed.

Please be aware that you can only use this method if you are requesting a waiver of the penalty and there is no taxable amount on Form 5329 form line 55 that must be transferred to Schedule 2 line 8.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tcondon21

Returning Member

kgsundar

Level 2

kgsundar

Level 2

werty

Level 1

rk38

Level 2