in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Do I subtract all of Social security benefits on line 11 of Maryland state form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I subtract all of Social security benefits on line 11 of Maryland state form?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I subtract all of Social security benefits on line 11 of Maryland state form?

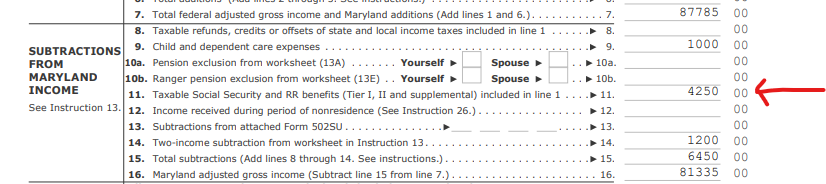

Yes, the entire taxable portion of your Social Security benefits are subtracted on line 11 of the Maryland form 502.

The taxable portion is deducted from the Federal adjusted gross income to compute the Maryland adjusted gross income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I subtract all of Social security benefits on line 11 of Maryland state form?

Hello James,

My turbo tax Maryland State form which was completed does not deduct the total of my husband and my benefits. It has reduced the total by almost 11000 dollars. Why is that?

Thank you,

Linda

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I subtract all of Social security benefits on line 11 of Maryland state form?

Maryland will deduct only the taxable portion of your Social Security benefits.

The taxable portion will be found on line 6b of the Federal 1040 tax return. The total benefit will be found on line 6a. See here.

Is this the same amount that you are seeing on line 11 of the Maryland 502 tax form?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lanyah88

Level 1

IY

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

LD71

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

timulltim

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

NH16

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill