- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Backdoor Roth IRA conversion entered caused an error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA conversion entered caused an error.

Followed all TurboTax instructions for CD version.

At the review stage I got the error:

IRA Contribution Worksheet: Line 15 - Amount of spouse's IRA contribution elected to make nondeductible should not be more that $(amount less than what my spouse contributed).

How to get past this step?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA conversion entered caused an error.

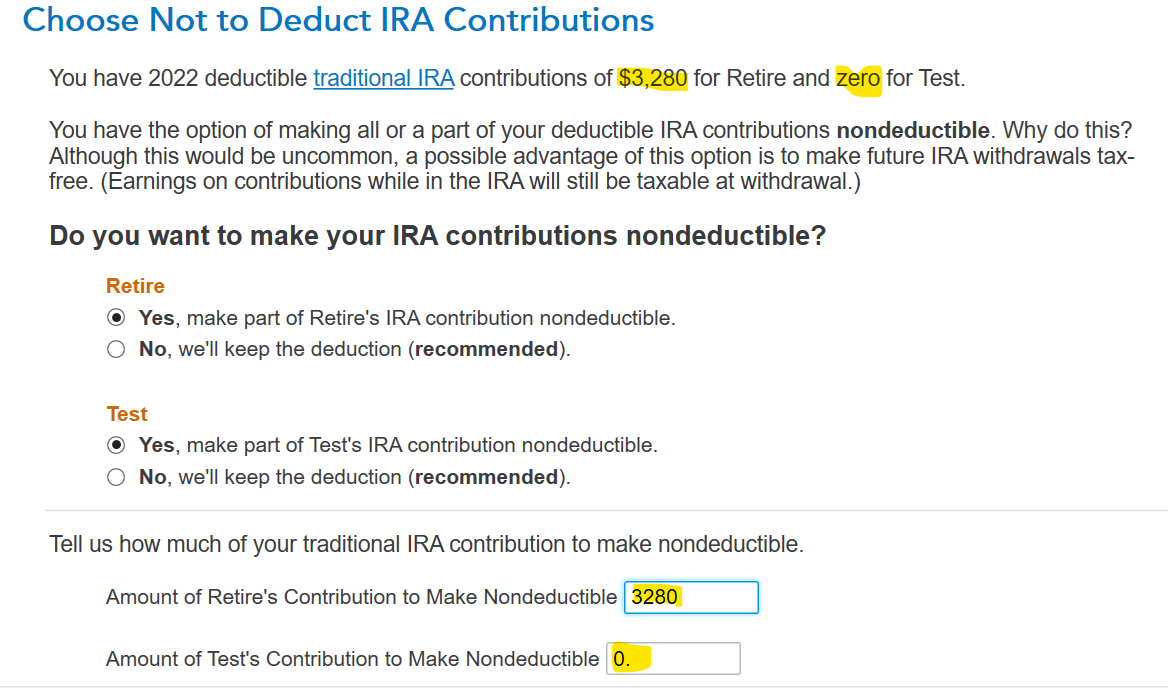

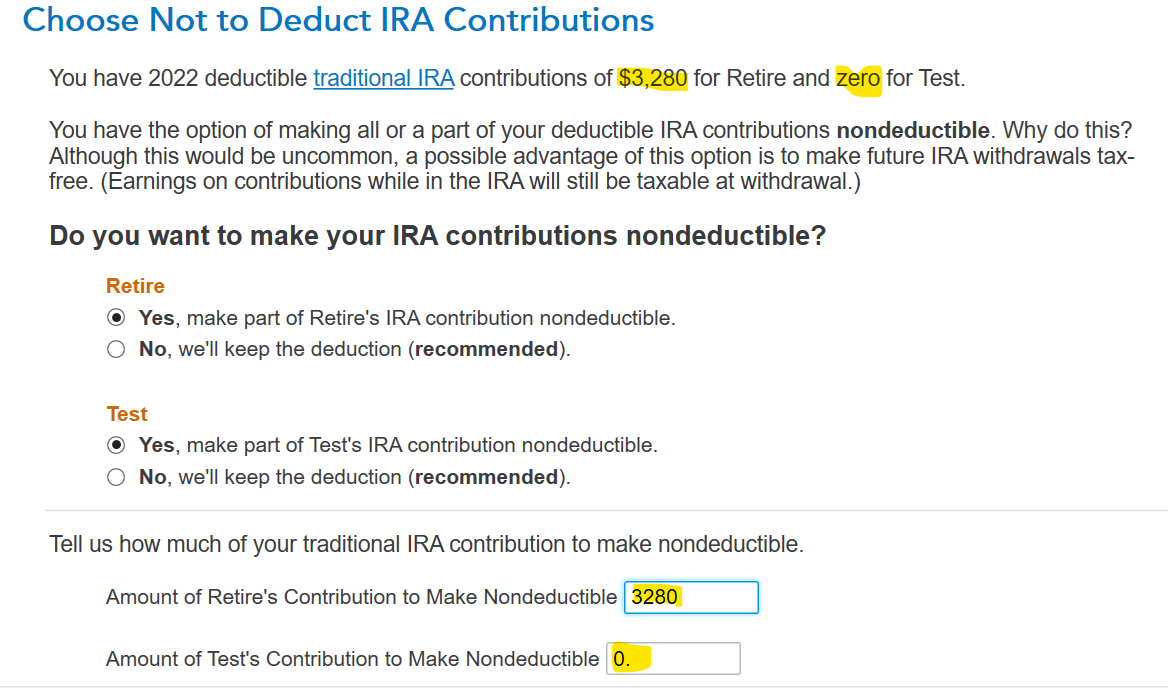

It seems that part of the contribution was automatically nondeductible because of the IRA deduction limits. Please check the “Choose Not to Deduct IRA Contributions” screen it should state the amount that is still deductible. This is the amount you enter to make nondeductible (not the total contribution amount since part of the contribution is already automatically nondeductible).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA conversion entered caused an error.

Yes, you would enter $5,730 since $1,270 are already automatically made nondeductible by the IRA deduction limit. This will result that the full $7,000 will be nondeductible and entered on Form 8606.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA conversion entered caused an error.

It seems that part of the contribution was automatically nondeductible because of the IRA deduction limits. Please check the “Choose Not to Deduct IRA Contributions” screen it should state the amount that is still deductible. This is the amount you enter to make nondeductible (not the total contribution amount since part of the contribution is already automatically nondeductible).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA conversion entered caused an error.

Thank you very much for the explanation!

Most likely that's exactly the case. I can see on the forms the following:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA conversion entered caused an error.

Yes, you would enter $5,730 since $1,270 are already automatically made nondeductible by the IRA deduction limit. This will result that the full $7,000 will be nondeductible and entered on Form 8606.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA conversion entered caused an error.

@DanaB27 - Thank you very much!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tcondon21

Returning Member

Divideby7

Level 1

VAer

Level 4

VAer

Level 4

VAer

Level 4