- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- 2020 RMD deferral

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 RMD deferral

I did not receive 1099Rs for those IRAs that I chose to not receive a RMD in 2020. What do I do with those accounts in the list of IRAs on TT and where do I enter the total value of IRA accounts as of Dec 31st ? All this assumes we will return to taking RMDs in 2021.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 RMD deferral

Yes, RMD were waived in 2020. If you did not take RMD and did not get any 1099-R then you will have to delete the 1099-R information from your 2020 return. Also, when TurboTax asks indicate that you were not required to take RMD.

- Login to your TurboTax Account

- Click on the Search box on the top and type “1099-R”

- Click on “Jump to 1099-R” and you should see the “Review your 1099-R info” screen

- Click on the "trash icon" to delete the 1099-R information.

You will not have to enter the value of your IRS on the tax return if you didn't take any distribution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 RMD deferral

Thanks for the answer, a few additional details: I took a partial RMD from one IRA that was a QCD and zero from the other 5 IRAs. I have deleted those from the list. Normally Forms 8606 were calculated for the adjustment since some of the IRA contributions were non-taxed and others were post taxed so there was adjustment to the taxable amounts. How will that information be carried forward to 2022 when we file 2021 taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 RMD deferral

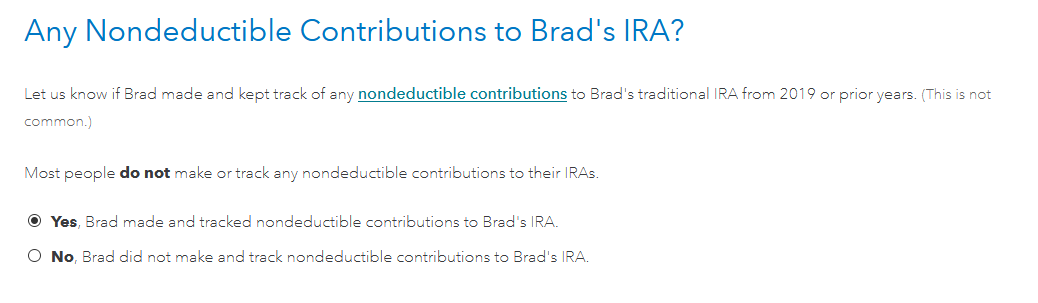

When you re-enter the 1099Rs, you will be asked for basis information on non-deductible contributions. Keep your 8606 from 2019 as you will need to enter your IRA basis in 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 RMD deferral

Thanks - That is what I expected was the approach and wanted to be certain.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

anonymouse1

Level 5

dan-richardson29

New Member

VolvoGirl

Level 15

mmehring

Returning Member

danasmith474

New Member