- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- 2020 Amended Return on 8606

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Amended Return on 8606

Hello!

I need help with 1099-R for a recharacterization event done in 2021 for a 2020 AND that I may have accidentally filled a 8606 when I didn't need to for 2020.

For context:

While doing this year's taxes, I believed I have asked the right question to appropriately fill my 8606 form and ending with a total basis (line 14) of $0. See link for that discussion.

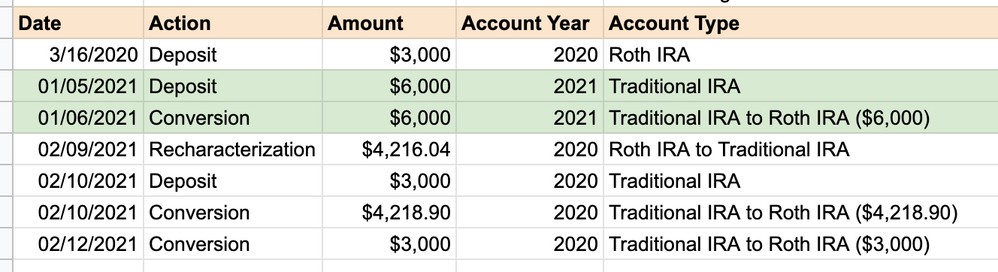

However, I believed I have filled my 2020's form 8606 completely wrong. In 2020, I found out too late that I no longer qualified for Roth IRA and I attempted to re-characterized. See the below chart for dates of execution:

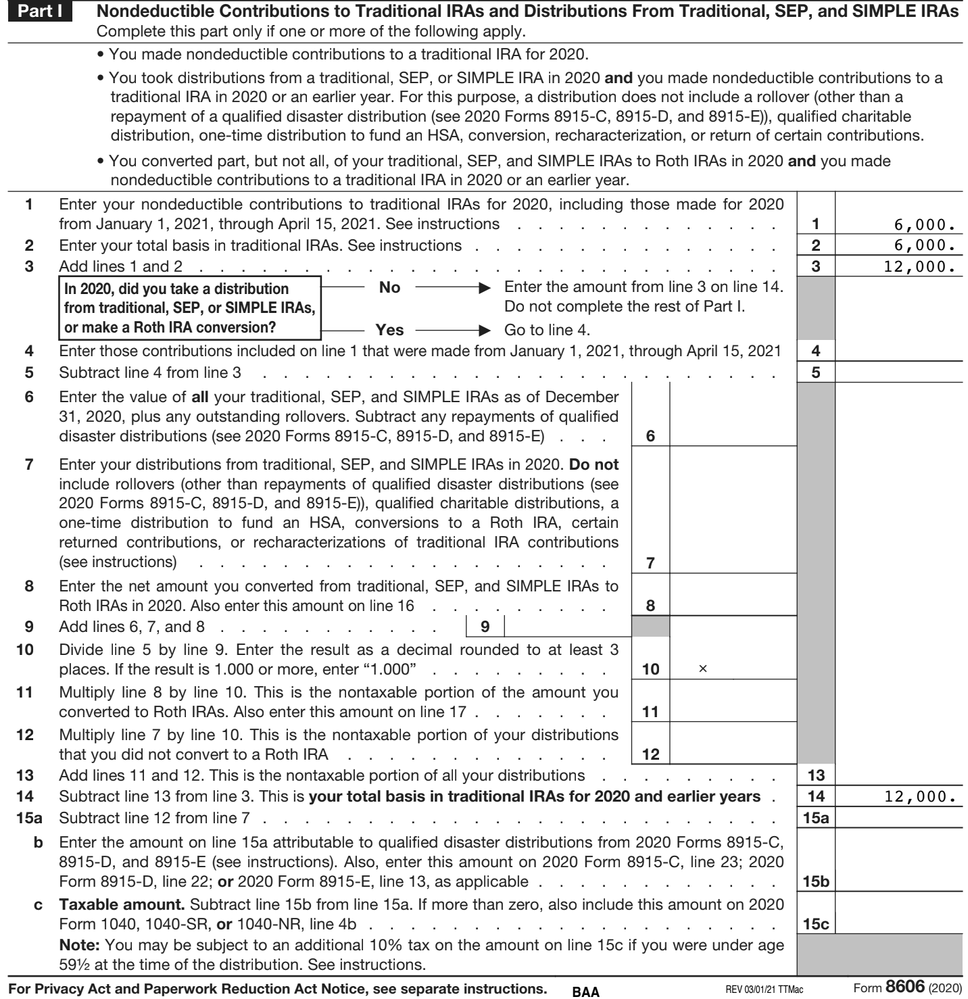

However, when filling out my 2020 taxes, I was quite confused and thought I had a basis (I honestly did not know what I was doing then). This is what my 2020 8606 looked like:

Now using TurboTax2020 Premier (Mac), I am attempting to fix this. These are my steps. Would someone kindly help validate if they are done appropriately?

1. Selected 1099-R and entered my re-characterization form that I received in 2021.

2. Navigated to "Deductions and Credits" > "Update" (Button)

3. Searched for "Traditional and Roth IRA Contributions"

4. Selected both "Traditional IRA" and "Roth IRA"

5. Yes -> "Did you Contribute To a Traditional IRA?"

6. No -> "Is This a Repayment of a Retirement Distribution?"

7. "3000" -> "Your total 2020 traditional IRA contribution"

8. "3000" -> "Tell us how much of the above total contribution for 2020 you contributed between Jan 1, 2021 and May 17, 2021"

9. No -> "Did you change your mind?"

10. Yes -> "Retirement Plan Coverage?"

11. No -> "Any Excess IRA Contributions Before 2020?"

12. No -> "Any Nondeductible Contributions to Your IRA?" (Since I only started this for 2020)

13. "0" -> "Value of your Traditional IRAs on December 31, 2020"

14. Yes -> "Did you make a Roth IRA contribution for 2020?"

15. No -> "Is This a Repayment of a Retirement Distribution?"

16. "3000" -> "Enter Your Roth IRA Contributions"

17. Yes -> "Switch from a Roth To A Traditional IRA?"

18. "3000" -> "Tell Us How Much You Transferred"

19. Roth IRA Explanation Statement:

Date of the Original Contribution: 3/16/2020

Date of the Recharacterization: 02/09/2021

The Amount Recharacterized: $3000.

The Amount Transferred (Recharacterization plus earnings or losses): $4216.04

Reason for the Recharacterization: No longer qualified for Roth IRA

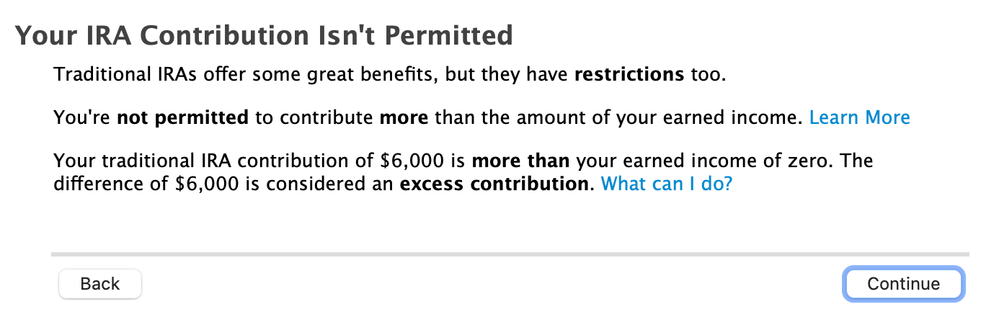

Unfortunately, I bumped into a strange error. It says my IRA contribution isn't permitted.

Also, line 14 in Form 8606-T shows a basis of $6,000. I was expecting "$0".

So from here,

1. Should I Import my 2020 W-2 then come back to this screen? (I sadly did lose my .tax2020 for importing, but have the .pdf).

2. Correct any steps from 1-19 from above? I am assuming I'm supposed to get "0" from line 14?

Thank you for your time and input!!!

Danny

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Amended Return on 8606

Yes, you will have to enter your 2020 W-2 on your 2020 tax return because right now TurboTax believes you had no earned income and therefore you would not be allowed to make the contribution.

No, you should have a $6,000 basis on your 2020 Form 8606 line 14 (assuming you had no prior basis left in the traditional IRA from 2019 and earlier). You made the $3,000 contribution to the traditional IRA and you recharacterized another $3,000 to the traditional IRA and made these nondeductible therefore you will have a total of $6,000 on line 14 to carry over to 2021.

It seems you have entered the traditional IRA and recharacterization correctly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

reynadevin28

New Member

ahkhan99

New Member

20tprtax

New Member

berniek1

Returning Member

berniek1

Returning Member