- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- 1099-r

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-r

my mom is retired and has a 1099-R form from policemen annuity pension. . When turbo tax asked is she has 1099-r the option were for 401k. where do I enter this type of 1099-r

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-r

The box 7 code and interview questions will determine the taxable amount.

Enter a 1099-R here:

Federal Taxes,

Wages & Income

(I'll choose what I work on - if that screen comes up)

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R).

OR Use the "Tools" menu (if online version left side) and then "Search Topics" for "1099-R" which will take you to the same place.

Be sure to choose which spouse the 1099-R is for if this is a joint tax return.

Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R.

[NOTE: When you get to the "Your 1099-R Entries" screen where you can add another 1099-R, use "continue" to keep going as there are additional interview questions after that screen in most cases. You can always return as shown above.]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-r

Form 1099 R is used for all types of retirement accounts.

The data entry is the same for distributions from pensions, IRAs, 401ks and annuity distributions.

When you get to that section, choose the first option;

Form 1099R withdrawal of money from 401(k), retirement plan, pensions, IRA's etc.

Continue through the on-screen questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-r

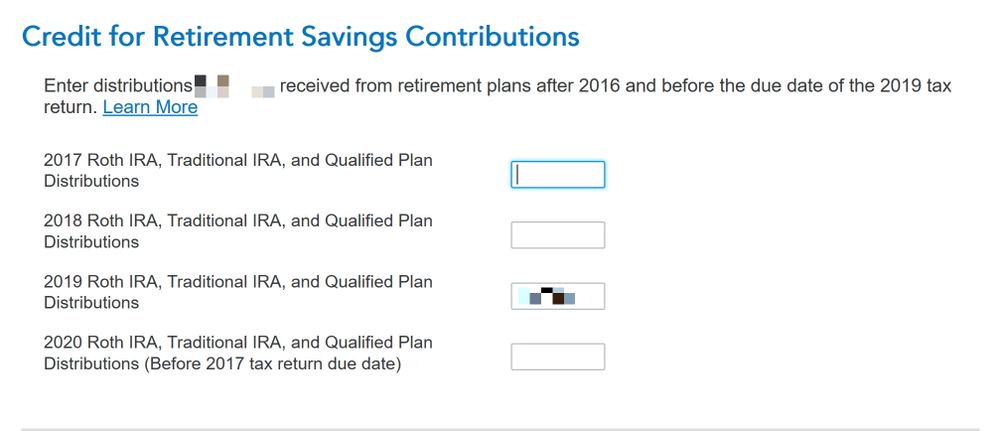

My wife left the ministry we both worked out and is rolling over her Employee Retirement account into her Roth. We are planning on recording half of it for this year and the other half next year. on the screen its asking me about 2017, 18, 19 & 20 distributions. 2020 does say (before 2017 tax return due date) So should I put the remaining amount we plan to rollover for next year in the 2020 box or not?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-r

@coolkiwilivin wrote:

My wife left the ministry we both worked out and is rolling over her Employee Retirement account into her Roth. We are planning on recording half of it for this year and the other half next year. on the screen its asking me about 2017, 18, 19 & 20 distributions. 2020 does say (before 2017 tax return due date) So should I put the remaining amount we plan to rollover for next year in the 2020 box or not?

Exactly what form do you have (a 1099-R I assume) and what code is in box 7?

Is the IRA/SEP/SIMPLE box checked?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-r

I have a 1099-R. We rolled her pension over to her roth. our financial advisor did half for this year and we will do the other half next year. I don't have a 1099-R for 2020 yet but TT asked about 2020 so wasn't sure if I should go ahead put that in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-r

From your description, you should get two 1099-Rs, one in early 2020 for tax year 2019, and the other in early 2021 for tax year 2020.

What did TurboTax ask about which referenced 2020? You have no reason to enter anything to do with the second distribution in your 2019 tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-r

Again, what code is in box 7? The questions asked depend on the code.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-r

Box 7 says distribution code and in it is the Letter G. thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-r

here is the screen:

I'm assuming I'll get the 1099 for 2020 next year but wasn't sure if I needed to put the future amount in there or just leave it blank & I assume in 2021, I'll put in the this years amount in the 2019 field.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-r

@coolkiwilivin wrote:

Box 7 says distribution code and in it is the Letter G. thanks!

A code G is a direct trustee-to-trustee rollover. If this was a rollover to a Roth IRA then the box 2a taxable amount should be the same as box 1 less any amount in box 5.

If box 2a is zero on the 1099-R then the 401(k) trustee specified that this was a rollover to a Traditional IRA and not a Roth IRA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-r

@coolkiwilivin wrote:

here is the screen:

I'm assuming I'll get the 1099 for 2020 next year but wasn't sure if I needed to put the future amount in there or just leave it blank & I assume in 2021, I'll put in the this years amount in the 2019 field.

That is the Savers Credit and only applies to new retirement plan contributions. Rollovers and conversions are not new contributions and are not entered at all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-r

Where on the NC income tax form do I enter my 1099R Federal pension exclusion?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-r

After you enter your 1099R into your federal return, you will arrive that says select your state. When you select North Carolina, there will be a screen asking where the distribution is from and then it will ask the source of the distribution. You need to fill out this section in order to exclude the income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-r

when do I have to make my 2019 sep/ira contribution

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

AnitaB1

New Member

William Baldwin

Returning Member

Mei1

Level 2

Max171

Level 1

persimman

Level 2