- Community

- Topics

- Community

- :

- Discussions

- :

- Other financial discussions

- :

- Other finance talk

- :

- Re: Accidentally received Stimulus Check

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally received Stimulus Check

My 19 year old daughter received the stimulus check despite being claimed as a dependent by my husband and I. We suspect it may be because of a mistake made on her own tax return last year, but we cannot find her tax return from last year in order to see what went wrong. We sent for copies of them, but haven't received copies yet, so we can't be sure what the mistake was that caused her to receive stimulus money. Is the money spendable? Will the IRS want to collect this money once they realize a mistake has been made?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally received Stimulus Check

did you daughter complete her 2019 tax return. I suspect she did not indicate she CAN be claimed by someone else. that is a common error among young adults. from what I have seen, the IRS is not using 2018 tax return currently to determine stimulus payments

The "right thing to do" is for her to return the money, DO NOT wait for the IRS to find the mistake - since your daughter knows it is a mistake it is her (and not your) responsibility to decide to return it.

Understand she signed a tax return where she stated (see the signature line): "Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. "

Now that she knows it is not true, correct and complete, she is LIABLE. You are not liable.

if YOU make the decision that she keeps the money and the IRS finds out, they will come after her, and not you! It is quite possible they will figure it out because you claimed her and they sent her a $1200 payment - quite easy to figure out.

Suggest she send the check back to the IRS by making the check out the the US TREASURY (or if she received a paper check, just write void on it) and include a brief note stating she inadvertently failed to check the box that she CAN be claimed on someone else's tax return and be sure her SS number is on the check.

Click this link to determine the mailing address:

hope that helps... and please do the right thing.....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally received Stimulus Check

I wouldn't send the check back simply because i read several mistake such as this one have been made and the response IRS gave was to keep the money. Example: one person wrote they received a stimulus check for a dead family member and was told to keep the money. Just think about others who have received the same . Have you heard of anyone post anything about IRS demanding that people send back their stimulus check if you were not eligible to receive one??? Keep it and enjoy it like you are a republican!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally received Stimulus Check

@lisa sweet WOW - are you encouraging stealing? is that American?

There is a RADICAL difference between receiving the stimulus if you are deceased (your may have been alive when the law was passed and therefore entitled to it and the only example you provided), and having an error on your tax return.

if your tax return was WRONG whether by accident or purposely being a good principled American means RETURN THE MONEY as it was an ill gotten gain

When the IRS finds out it was incorrect (they do audits!!), there are fines, penalties and potential jail time involved

just above your signature line on your tax return is this statement, which is how the IRS can come after you:

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete.

I have seen articles that when the stimulus occurred in 2009,, family members of the deceased returns over 70% of the money received by deceased tax papers. THEY DID THE RIGHT THING

Are you encouraging a 19 year old to steal! (she knew the tax return had an error in it) Your post shows an incredible lack of responsibility. We are a more principled nation than that. THAT is the future of this country.

Enjoy your day.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally received Stimulus Check

It is okay for people to keep the money from dead family members. Why should this be any different?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally received Stimulus Check

@Mandy3rn because a dead person didn't fill out a tax form incorrectly. And from the 2009 experience, most families returned the money as the 'right thing to do', even though not required.

in the case above, the TAXPAYER FILLED OUT the tax form incorrectly. The money was ill-gotten and violates the statement that all of us sign at the bottom of the tax form. You are liable for penalties, interest - and in the most egregious cases - jail time - for filing an incorrect form and not correcting it once it is known to be incorrect. Failure to return money that is ill-gotten is tax fraud!

That is why.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally received Stimulus Check

That makes sense. You seem to know a lot about this so if you don't mind I would like to ask a question. My husband owes back child support. So instead of just off setting our stimulus money they offset the amount that was supposed to help with our children. What should I do? I haven't recieved the 15 day letter from the IRS yet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally received Stimulus Check

@Mandy3rn - you would have to fill out the injured spouse form to get your half of the stimulus; as long as he owes back child support his half is garnished - it's the one item that Congress permitted to be garnished in the CARES Act. without that form, your half is garnished also.

google IRS FORM 8379

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally received Stimulus Check

Thanks so much!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally received Stimulus Check

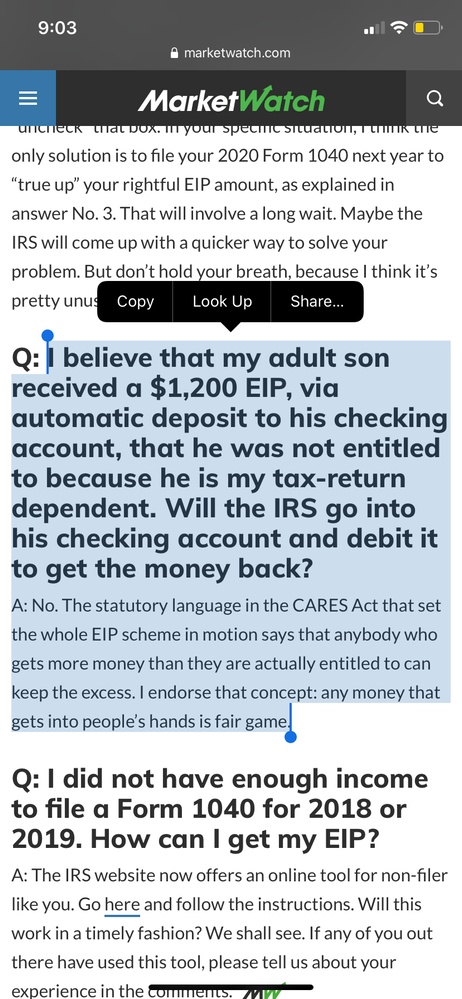

Thank you for your replies! They have provided some much needed info and insight on to what our next steps should be. When doing some other research I saw that this was a similar situation to my daughters, but had a different answer than what you provided. You seem to be pretty knowledgable on this topic so if you have any insights or opinions about this response it would be greatly appreciated. @NCperson

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally received Stimulus Check

@NCperson you are not helpful in any way. You should mind your own business haha

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally received Stimulus Check

Please quit talking about the cares act if you cant even read it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally received Stimulus Check

Also dont tell someone they are un-American for trying to keep a stimulus check. Go check trump's tax returns and get back to me. Wait... you can't...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

alija0805

Returning Member

LmT2

Returning Member

RJSiebert97

New Member

estebanlomas

New Member

jaks_dls2019

New Member