- Community

- Topics

- Community

- :

- Discussions

- :

- Other financial discussions

- :

- Other finance talk

- :

- 2nd stimulus check

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2nd stimulus check

So your telling me your rep lied when she told me exactly how much I was getting where I was getting it the date it got rejected and the day it was re-deposited? Not yet still not on my bank?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2nd stimulus check

If you have not yet received the second stimulus payment it is not lost. However, it must be reconciled on your tax return for 2020.

There were some IRS issues with the second stimulus deposits. For those who did not receive their second stimulus check there is a Recovery Rebate Credit that will part of your tax return which will include it with the rest of your refund. Please use the links below for more information.

- When will I get my second stimulus check? (scroll to this question when you select the hyperlink)

- Why haven't I received my second stimulus check?

- IRS Recovery Rebate Credit

In TurboTax Online once your return is open, select Wages & Income (to enter the tax return).

Select Federal Review at the top of the page > Continue to answer the questions for Let's make sure you got the right stimulus amount

TurboTax will then include any stimulus amount due on your Form 1040 - either added to increase your refund or it will reduce the amount due, if applicable..

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2nd stimulus check

@DianeW777 Now I'm confused. TT sent an email on 1/10 informing many people that the IRS has our payments and would deposit them into our accounts by the end if the month.

Are you now saying that if we haven't received it as of today, that it will need to be claimed on our taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2nd stimulus check

Not today! The IRS does not open until February 12 -after they are done distributing stimulus checks. Dianne meant that when the IRS opens for accepting return on February 12, if you have not received your stimulus, then you can add that to your refund. Please continue to wait on the IRS and check the IRS Get My Payment tool.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2nd stimulus check

I just filed my income tax yesterday, I never received the 2nd stimulus check, I didn’t see a prompt for if you didn’t receive your check. Now that I’ve already filed, how do o get my stimulus? Travis Hehn

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2nd stimulus check

It depends.

First, I would recommend looking at your return to ensure the Recovery Rebate Credit was not already included in your return.

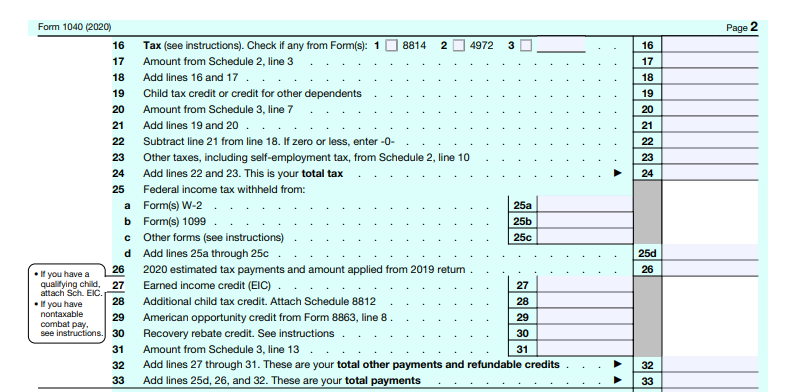

You will need to look at your Form 1040. If you claimed the Recovery Rebate Credit, it will show up on Page 2, line 30 of your Form 1040 as the Recovery Rebate Credit. See the sample form below.

This amount is generated from TurboTax based upon your input as follows in the Federal Review input section.

The amount of the Rebate Recovery Credit is based upon your actual 2020 income tax return you file. Therefore, if you meet the criteria for the credit, you will receive it when you prepare your 2020 income tax return. The credit is intended to give those who should have received a stimulus payment but never did a tax credit on their tax returns. Any excess credit is then refunded to you if there is an overpayment on your tax return.

Please see the attached link for more information on who can claim the credit.

Recovery Rebate Credit eligibility

If there is no amount entered in the Recovery Rebate Credit section above, you would need to amend your return to calculate it.

Correcting Recovery Rebate Credits on returns already filed

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dierings

New Member

chrissmithgl

New Member

SLYKTAX

Level 5

osoperezoso

New Member

LmT2

Returning Member