- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Other financial discussions

It depends.

First, I would recommend looking at your return to ensure the Recovery Rebate Credit was not already included in your return.

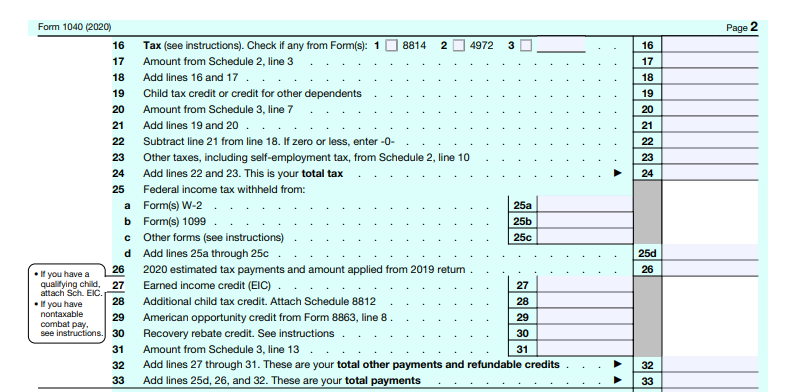

You will need to look at your Form 1040. If you claimed the Recovery Rebate Credit, it will show up on Page 2, line 30 of your Form 1040 as the Recovery Rebate Credit. See the sample form below.

This amount is generated from TurboTax based upon your input as follows in the Federal Review input section.

The amount of the Rebate Recovery Credit is based upon your actual 2020 income tax return you file. Therefore, if you meet the criteria for the credit, you will receive it when you prepare your 2020 income tax return. The credit is intended to give those who should have received a stimulus payment but never did a tax credit on their tax returns. Any excess credit is then refunded to you if there is an overpayment on your tax return.

Please see the attached link for more information on who can claim the credit.

Recovery Rebate Credit eligibility

If there is no amount entered in the Recovery Rebate Credit section above, you would need to amend your return to calculate it.

Correcting Recovery Rebate Credits on returns already filed

**Mark the post that answers your question by clicking on "Mark as Best Answer"