- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- Should i mark active military if i was discharged

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should i mark active military if i was discharged

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should i mark active military if i was discharged

No, if you were discharged, you are no longer active duty.

A military discharge is given when a member of the armed forces is released from their obligation to serve. Therefore, you are no longer an active duty member.

Individuals who voluntarily separate from active duty with fewer than eight years service will normally fulfill the balance of their term in the Individual Ready Reserve (IRR). However, they are still not active duty.

You may qualify as a veteran, and that may provide some additional benefits.

"The IRS defines a veteran as a former US service member who served on active duty for at least 24 months and who wasn't dishonorably discharged. When it comes time to file your taxes, remember that as a veteran, tax benefits may be available to you, your spouse, your children, and your parents."

Please see the TurboTax article 5 Tax Breaks for Veterans

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should i mark active military if i was discharged

@stormberry1119 BUT>>>>>

I'm going to say YES...but only if you were discharged during 2023, and receive a DFAS W-2 form for 2023 Military wages.

__________________

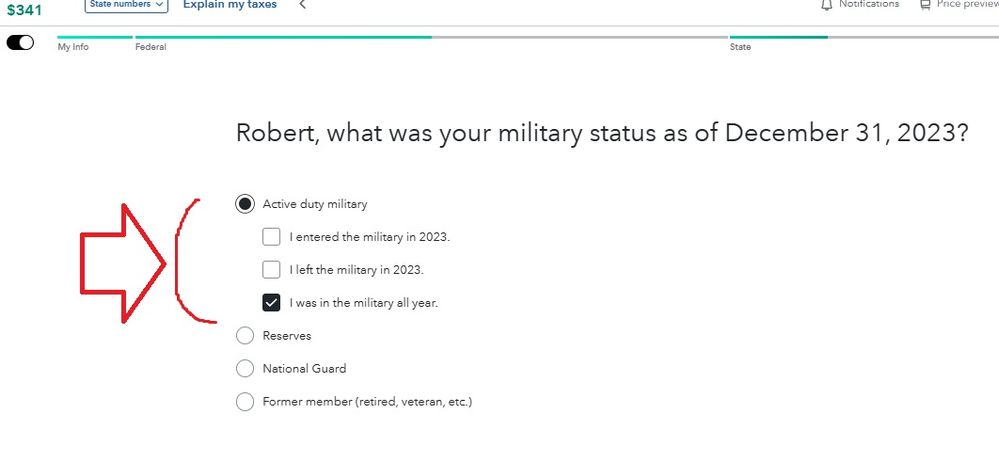

Once you indicate you were active duty during 2023 (Edit yourself on the My Info page), on a page after that initial question, you will then get to indicate whether you were in all year...or entered during 2023, or left during 2023......that is where you indicate you weren't in all year.

But being active duty with a DFAS W-2 for any service during 2023 qualifies.

_________________________________

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

mbeer01

Level 1

long-shot

Returning Member

k-staring

New Member

c-mbrooks

New Member

Stupidasur3

Level 4