- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- In an Ohio state return, how to indicate that my income is from active duty military? I should get all my taxes back due to Ohio not taxing military pay.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In an Ohio state return, how to indicate that my income is from active duty military? I should get all my taxes back due to Ohio not taxing military pay.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In an Ohio state return, how to indicate that my income is from active duty military? I should get all my taxes back due to Ohio not taxing military pay.

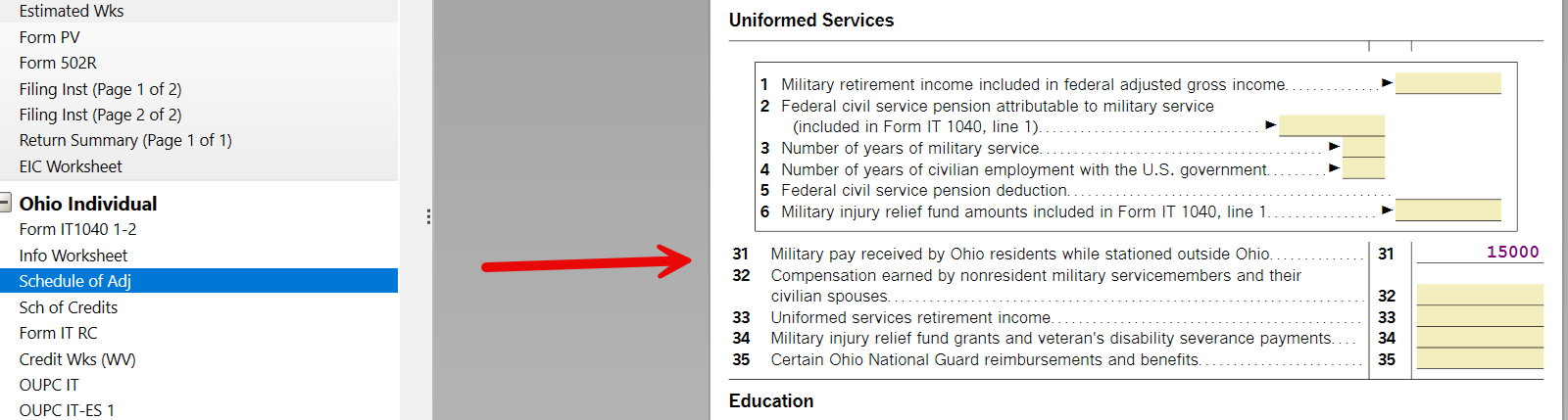

You will need to go back to your W2 entry under Federal Income, and look for the screen below- You must check you are Active Military Duty here. Then go back to the Ohio section and you will get the questions to exclude your income.

Generally, all income earned by Ohio residents is subject to Ohio individual income tax. However, Ohio law allows military servicemembers to deduct on Ohio Schedule A any active duty military pay and allowances that were received while the servicemember was stationed outside of Ohio. Thus, Ohio resident servicemembers stationed outside Ohio are not liable for Ohio income tax on their military pay and allowances.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In an Ohio state return, how to indicate that my income is from active duty military? I should get all my taxes back due to Ohio not taxing military pay.

I have the active military box checked, but don’t get any more questions in the state tax section. Under state/income the only thing under the military section is Nonresident Military and Civilian Spouse Wages Deduction and that doesn’t apply to us because he IS a resident.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In an Ohio state return, how to indicate that my income is from active duty military? I should get all my taxes back due to Ohio not taxing military pay.

There is a difference between HOR and residence. If the HOR is Ohio and he is a resident, then the pay is taxable. If he stationed in Ohio-but not HOR-then there is an adjustment. See Military FAQs

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In an Ohio state return, how to indicate that my income is from active duty military? I should get all my taxes back due to Ohio not taxing military pay.

Where can I find the Ohio schedule A on turbo tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In an Ohio state return, how to indicate that my income is from active duty military? I should get all my taxes back due to Ohio not taxing military pay.

The adjustments form is accessed by going through Ohio to Here's the Income that Ohio handles differently. Be sure you have military marked in the personal information screen and where stationed outside of OH to qualify for the deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

demarius1211

New Member

user17525940873

New Member

drildrill23

Returning Member

smfwalker

Level 2

cpo695

Returning Member